From 2026, Singaporeans are set to pay higher insurance premiums for their national long-term care insurance scheme, CareShield Life. This change has been confirmed after the Government accepted the CareShield Life Council’s recommendations after the CareShield Life 2025 Review. With this in mind, let’s learn about the changes and how they will affect you next year.

Table of Contents:

- What is CareShield Life

- Growth Rate for CareShield Life’s Payouts

- Insurance Premium Adjustments

- Government Subsidy

- Underwriting Criteria

- Reasons for these changes

- Target Audience

- Who can claim

- What’s next?

One Minute Summary:

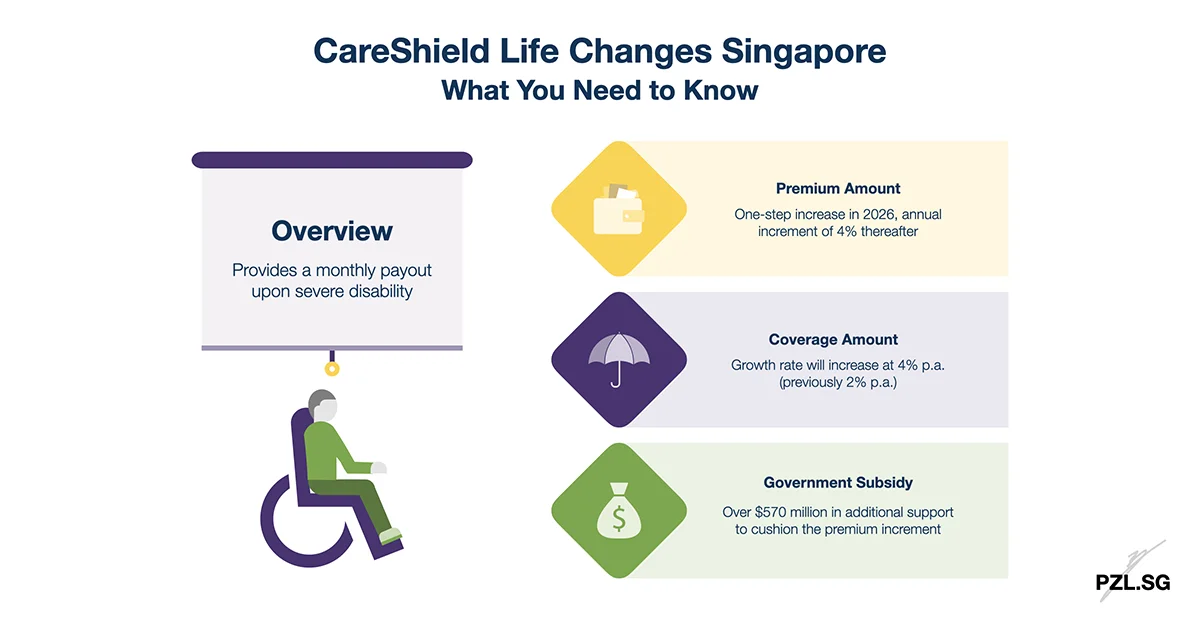

- CareShield Life provides a monthly payout if you cannot perform three or more Activities of Daily Living.

- From 2026, CareShield Life will resume its usual underwriting criteria for all Singaporeans.

- From 2026 to 2030, the monthly payouts will increase at 4% annually (up from 2% annually).

- After a one-step increase in the insurance premiums in 2026, CareShield Life’s insurance premiums will increase by 4% each year.

- The Government will provide $570 million in additional support to subsidise the hike in the insurance premium.

Part 1: What is CareShield Life

Launched in 2020, CareShield Life is our nation’s latest severe disability income insurance scheme. This will gradually replace the older ElderShield scheme. Similar to ElderShield, you will receive a monthly cash payout if you become severely disabled; that is, if you cannot perform three or more Activities of Daily Living. Unlike ElderShield, there is no limit on the claim payout duration. In other words, CareShield Life will provide the monthly payout for as long as you remain disabled.

Part 2: Growth Rate for CareShield Life’s Payouts

At launch, CareShield Life’s monthly payouts were set to increase at 2% annually. From 2026 to 2030, these payouts will increase at 4% annually. With this enhancement, if you make a claim in 2030, you will receive a payout of $806 per month. This is as compared to a payout of $731 per month under the previous 2% annual growth rate.

| Year of Claim | Current Structure | Enhanced Structure |

|---|---|---|

| 2026 | $676 | $689 |

| 2027 | $689 | $717 |

| 2028 | $703 | $745 |

| 2029 | $717 | $775 |

| 2030 | $731 | $806 |

Meanwhile, CareShield Life’s claim criteria remains the same, i.e., you will receive a monthly payout if you cannot perform three or more Activities of Daily Living.

Part 3: Insurance Premium Adjustments

CareShield Life’s premiums have to increase to sustain the higher monthly payouts. After a one-step increase in premiums in 2026, the insurance premiums will increase by 4% each year. In absolute terms, the average annual increase is $38, up to $75 each year.

Part 4: Government Subsidy

To cushion the impact of the premium increment, in addition to the existing premium subsidies, the Government will provide over $570 million in additional support over the next five years. To list,

- There will be a broad-based transitional support of $440 million to moderate the premium increase for all affected policyholders.

- Over $130 million will be used to offer more support to low- to middle-income policyholders through more means-tested premium support.

Moreover, the Government has expanded the eligibility criteria for the Additional Premium Support. This allows more Singaporeans who are unable to afford their CareShield Life premiums to be covered under our nation’s long-term care insurance scheme. Above all, no one will lose coverage due to an inability to pay their insurance premiums.

To point out, without these support measures, the annual insurance premiums would have increased by $126 on average in 2026. This is compared to the average annual increase of $38 that I have mentioned in the earlier section.

Part 5: Underwriting Criteria

When CareShield Life was launched, older Singaporeans (born in 1979 or earlier) with mild or moderate disability were allowed to enrol in the scheme. However, this concession also meant that the insurance premiums for this age group had to be priced higher to account for the higher risks.

From 2026, CareShield Life will resume its usual underwriting criteria. In effect, this will moderate the extent of insurance premium increment for all older policyholders. This will keep our nation’s long-term care insurance scheme fair and sustainable.

Part 6: Reasons for these changes

Singapore’s annual national long-term care expenditure has almost doubled from $1.7 billion to about $3 billion in the last five years. This rate has outpaced both the general inflation and the existing annual payout growth rate of 2%. Without the upcoming changes, CareShield Life’s payouts would cover a smaller portion of the actual long-term care costs over time.

According to the Ministry of Health, among those who develop severe disability, half would remain disabled for at least four to five years, while three in ten could remain disabled for a decade or longer. With this in mind, CareShield Life must be updated to accommodate our ageing population’s needs.

Part 7: Target Audience

CareShield Life is optional for Singaporeans born in 1979 or earlier. Meanwhile, if you were born in 1980 or later, CareShield is a mandatory scheme for you. Two months before your 30th birthday, you will receive a welcome letter with your policy details.

Part 8: Who can claim

If you cannot perform three or more Activities of Daily Living, you can receive monthly cash payouts under CareShield Life. Thereafter, you will continue to receive the payout so long as you remain severely disabled.

According to the Ministry of Health, as of 2024, there are 1,821 active claimants under CareShield Life, with more than $26 million paid out in claims. The age of the claimants ranges from 30 to 93, with a median age of 52. These statistics indicate that about half of the claimants under CareShield Life are in their 30s and 40s.

Part 9: What’s next?

According to the Health in 2018, 1 in 2 Singaporeans who are healthy at age 65 could become severely disabled at some point in their lifetime and require long-term care support. Moreover, there is also an uncertainty about the duration a person remains severely disabled. Although the median duration of disability is four years, 30% of people could remain severely disabled for 10 years or more.

At this time, the estimated monthly costs for community care and nursing care are $2,700 and $4,900, respectively. Let’s assume that you are eligible for the various government subsidies and grants. Even so, your monthly out-of-pocket cost is around $110 to $510. This suggests that relying on CareShield Life’s payouts alone may not be sufficient to meet your long-term care needs. With this in mind, you may wish to review your existing resources or purchase a CareShield Life supplement to improve your existing long-term care insurance coverage.

Reference:

Government accepts CareShield Life Council’s recommendations to enhance CareShield Life, provides additional $570 million to subsidise premiums

Leave a Reply