Summing up, an emergency fund or a rainy day fund is a pool of money that you have at anytime to meet a personal financial crisis. Above all, everyone should have this pool of money and this is regardless of whether you are in a relatively comfortable position or struggling to make ends meet. In fact, some argues that you should keep this stack of cash under your bed so that it remains accessible at all times. Before you do so, the question is, what constitutes to an emergency fund? And how much should you stash under your bed?

Table of Contents:

- What is an Emergency Fund

- What is not an Emergency Fund

- Where to keep Your Emergency Fund

- The Typical 3 to 6 Months Guide

- Assessing Your Financial Risk

- How to Build Up Your Own Emergency Fund

- How much do You really need

One Minute Summary:

- When you have sufficient emergency fund, it gives you a greater peace of mind to know that you don’t have to worry about money in the event of a financial distress.

- In order to maintain an appropriate amount of liquidity, you need to be able to differentiate between an emergency and a non-emergency event.

- Rather than to follow the conventional 3 to 6 months guideline (blindly), use the financial risk assessment to determine how much you really need for yourself.

Part 1: What is an Emergency Fund

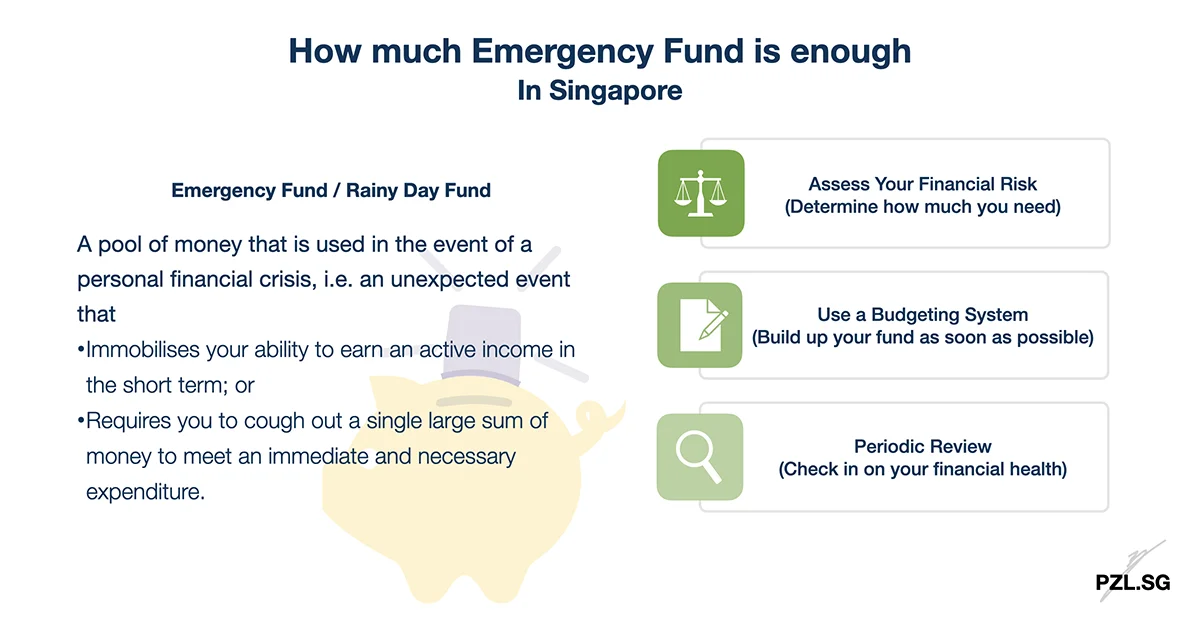

As its name suggests, an emergency fund is a pool of money that is used in the event of a financial emergency. Generally, we can classify a financial emergency into two categories; an unexpected event that either

- Immobilises your ability to earn an active income in the short term; or

- Requires you to cough out a single large sum of money to meet an immediate and necessary expenditure.

To illustrate, most of us rely on employment to earn an active income. Thereupon, the earned income is used to pay for expenditure such as food and bills. As a matter of fact, in the event that you lose your job, you will still need to foot the bills and to put food on the table. To this end, this is when you will tap into your emergency fund so that you can continue to meet your daily living needs. At the same time, you will use this period to look for another job so that you won’t deplete your emergency fund down to zero.

In another example, the refrigerator in your home breaks down and requires a replacement. Since this is an essential household item, you will likely replace it immediately. At the same time, the cost of a refrigerator is not exactly cheap. Consequently, rather than to wait for your pay cheque to arrive, it makes more sense to utilise a portion of your emergency fund to purchase a replacement unit immediately.

Part 2: What is not an Emergency Fund

It is without a doubt that you must be able to differentiate between an emergency and a non-emergency event. For instance, you booked a nice holiday to travel around the world and you need money to pay off the credit card that you have just swiped for this booking. Even though it is urgent and important to clear the credit card bill to prevent yourself from running into a debt, this is not an emergency and you should not utilise your emergency fund. In truth, this is a separate matter on prudent spending which I will discuss at another time.

Part 3: Where to keep Your Emergency Fund

After knowing what is an emergency fund and what it is used for, the next question is to find a place to store this stack of money. For this purpose, the rule is simple:

Keep it in a safe place where you will have the full access to the full amount at any time without any stress.

As a result, most of us will keep this pool of money in the bank. After all, it is easy to visit a nearby ATM machine to withdraw the required amount at anytime. At this point, I must highlight that the bank’s interest rate is not the utmost priority here. To put it another way, you shouldn’t be overly concerned about how much interest the bank gives you for parking your emergency fund with them. As I have noted earlier, accessibility should be the primary consideration when you choose where to store your funds. This is why the classic biscuit tin works perfectly well for this purpose.

At the same time, I will suggest against investing your emergency fund into bonds or any financial instruments that ‘locks up’ your money for a period of time. In fact, yes, you should probably avoid placing your emergency fund into a fixed deposit too. Although you may be able to withdraw your capital within the same day, the bank may apply an early withdrawal fee. Under those circumstances, it feels like a double punishment when you are forced to pay a fee to tide over a financial crisis that you didn’t expect to happen in the first place. Argh!

With this in mind, I will strongly encourage you to just keep things as simple as possible – find the simplest and most straightforward bank account and put your money there. Personally, I use a combination of UOB One Account and Singlife Account for my savings. For one thing, the latter is particularly great for short term savings – giving a non-guaranteed yield of up to 3.5% per annum for the first $10,000 deposit.

Part 4: The Typical 3 to 6 Months Guide

Part 4.1: 3 to 6 Months of What?

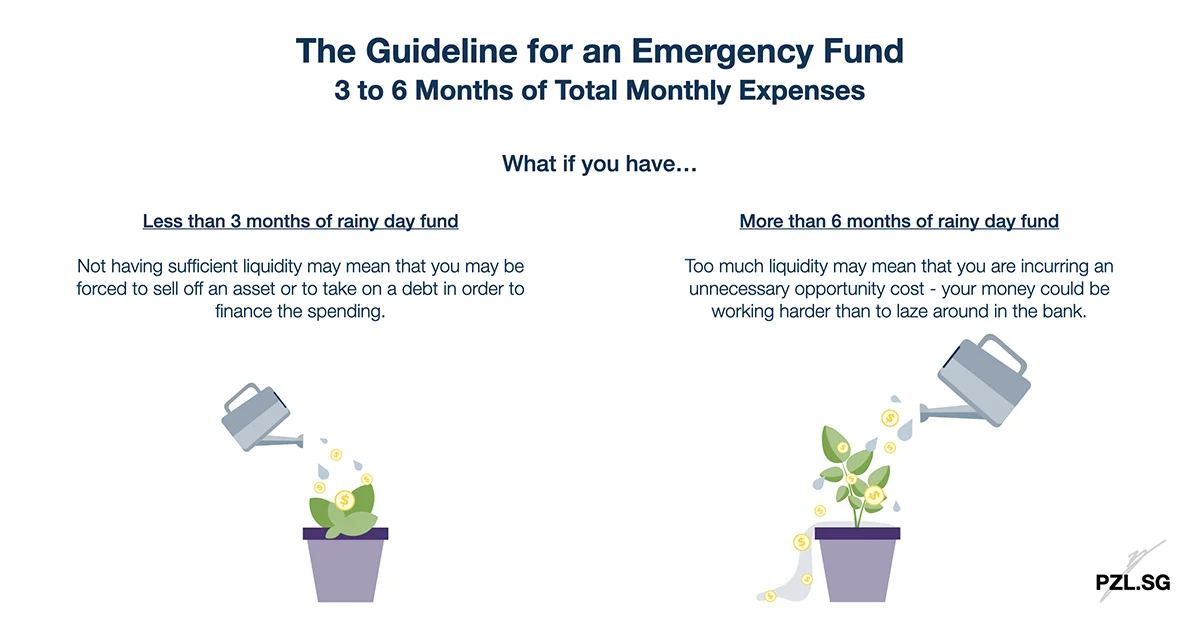

By and large, many advocate towards setting aside three to six months of a factor as your emergency fund. In detail, this factor is based on your total monthly expenses; not fixed expenses only, and certainly not based on your income. To clarify, if you set aside the amount based on fixed expenses only, then you will likely exhaust your emergency fund too quickly. After all, there are many variable expenses that are necessary for our survival too, e.g. food, transport.

On the other hand, if you set aside your emergency fund based on your income, then you will end up with too much money in the bank. In order to explain this, we will refer back to the primary purpose for setting up our emergency fund; that is to take care of expenses in the event of an unexpected situation. Since the primary purpose is to cater to an expense, we don’t need any additional amount beyond what we need to spend. Additionally, monies in your emergency fund usually don’t earn much return. Hence, you should keep as little as you need in your bank to overcome the crisis.

Part 4.2: Why the Magic Number 3 and 6?

For the most part, many of us have heard about saving 3 to 6 months of expenses as your emergency fund. Of course, some of you may wonder – why this amount? As I have explained earlier, we calculate your emergency fund based on your total monthly expenses. At this point, let’s imagine what happens if you lose your job yesterday. Under those circumstances, you can take up to three months to look for another job while ensuring that you are able to take care of your day-to-day needs. In similar fashion, if you have six months of rainy day fund, then you can double your job hunt period.

As a finance advocate, I always emphasise on the importance to spend below your means. To put it another way, you should spend less than what you earn. Consequently, in the event that you need to cough up money for an urgent purchase, it is unlikely that the cost will be more than the total amount that you have set aside for a rainy day. Consequently, most of us will need at most six months of total monthly expenses in cold hard cash.

Part 5: Assessing Your Financial Risk

Of course, not everyone uses the generic guideline and conforms by it. After all, we all have different risk appetite and perception towards money. Accordingly, this is how I will assess how much you should keep in your bank.

Part 5.1: Other Sources of Income

Firstly, do you have any other constant sources of income? To list, it may be dividend from your investment portfolio, rental income, or even income from your side hustle. To sum up, these sources of cash inflow helps to cushion the impact against the cash outflow. At this time, if you rely solely on employment to earn an income, then it is probably time to brainstorm on how to diversify your income sources.

Part 5.2: Employability

Secondly, we look at your employability. Generally, most of us rely on employment to earn an active income. Thereupon, the earned income is used to fund our purchases, i.e. fixed and variable expenditure. Given that relationship, in the event that you lose your job, what is the probability and timeline required to land the next offer? To this end, here are some questions for your consideration:

- What are your academic qualifications? E.g. Holds a degree

- What are some of your skillsets? E.g. Proficient in video editing softwares like Final Cut Pro X

- What is your experience? E.g. Over a decade of relevant experience in a particular field

- What are some of the soft skills that you have? E.g. Empathy

- How is the demand and supply like in your industry? E.g. Are there many people after the same role?

- What is your salary demand? E.g. How willing are you to settle for a lower salary?

For example, if you are in a specialised field where there is a higher demand and a limited supply in talent, then you may not be as worried about losing your job. This is because you are likely to secure another offer without any significant pay cut or downtime.

Additionally, we will also discuss your willingness to take on a lower pay grade on a temporary basis. To illustrate, you may be facing an issue on finding your preferred job for over two months now. Rather than to continue eating into your emergency fund, are you willing to take on an odd job to relieve some of your financial burden while you continue to look for a full-time position?

Part 5.3: Insurance

Rather than to rely on your emergency fund completely, it may be wise to use insurance as a hedging tool. As can be seen, I like to describe

insurance as a tool to provide the financial leverage for the money that you need but do not have.

For instance, you may be worried about the hefty medical bills in the event of a hospitalisation. As compared to keeping perhaps $100k in the bank, it may make more sense transfer the financial risk to the insurer by paying a much smaller premium. What’s more, who knows whether your medical bill will be kept within the $100k range. With this intention in mind, you should review your insurance portfolio when you are planning for your rainy day needs.

Part 5.4: Fixed Expenditure

Basically, fixed expenditure refers to your monthly cash outflow and this is independent of your earned income. In other words, even if you don’t earn an income, you will still need to spend money on these items every month, e.g. debt repayment and bills. If you have a high fixed expenditure ratio, i.e. more than 35% of your monthly income, then you may wish to expand your emergency pool. In effect, this will reduce the stress on your emergency fund.

Part 5.5: Variable Expenditure

In contrast, variable expenditure refers to the monthly cash outflow and this may vary from time to time, e.g. spending on food, transport. To point out, lifestyle expenses is a subset of your variable expenditure. Evidently, you tend to spend more when you earn more (though we tend to convince ourselves otherwise). Accordingly, you may wish to differentiate between a core variable expense vs a lifestyle expense. In effect, this allows you to ascertain how much you really need during a financial crisis.

Part 6: How to Build Up Your Own Emergency Fund

Part 6.1: An Automated Budget

Seeing the importance of an emergency fund, I like to use an automated budgeting system to build up my savings in a disciplined manner. In summary, as soon as you receive your pay cheque, you will transfer a portion of your earnings into your ‘savings’ bank account. For more details on how this method works, check out: How to create a Monthly Budget

Part 6.2: How much to allocate

Well, this is a very subjective question and it depends on your current financial position at this stage. Since it is imperative to have an adequate amount of rainy day fund, I will highly recommend you to accumulate as much as possible, and as fast and possible. Consequently, if you can set aside 50% of your monthly salary towards this financial goal, then do it. In contrast, if you are making ends meet, then start with a smaller amount that you are comfortable with, e.g. 5% of your monthly salary, or even just $10 a month. In either case, it must be remembered that you should set a realistic goal that you can achieve. This is so as to ensure that you remain committed and motivated to achieve this financial goal. Hence, don’t be embarrassed to start small. Remember, consistency is the key here!

Part 7: How much do You really need

All in all, the goal of an emergency fund is simple – to alleviate you from a financial distress during an unexpected event. Although it is crucial to set aside this pool of money, there is no need to overdo it. For example, after assessing your need, you may realise that you only need two months of rainy day fund. By comparison, you may have a lot of commitments and feel that eight months of rainy day fund will give you a greater peace of mind. With this in mind, here is what I will suggest you to do: Take a piece of paper and draw a mind map of all the unexpected events that may affect your financial wellbeing. For example, if you own a car, then you may require slightly more liquidity for car maintenance as compared to someone who don’t own a car. Consequently through this exercise, in addition to understanding yourself better, you will also become more confident about your finances. In any case, just bear in mind that there really isn’t much meaning to having excessively excess amount of money in the bank doing nothing. Therefore, just hold onto what you need and use the remainder to work on any financial goals that you have.

Leave a Reply