Summing up, through an insurance policy loan, you are able to borrow money from the accumulated cash value in your insurance policy. By and large, this is a common insurance policy feature for a participating plan. To list, examples of a participating plan includes an endowment savings plan, and a whole life insurance policy. Given that many of us would have come across a participating plan, let’s learn the benefits and cost to using an insurance policy loan in this post.

Table of Contents:

- What is a Participating Policy

- Requirements

- Types of Insurance Policy Loan

- Insurance Policy Loan Interest Rate

- Insurance Policy Loan Repayment

- Termination

- Should You take up an Insurance Policy Loan

One Minute Summary:

- On the whole, an insurance policy loan is a common insurance policy feature for a participating plan.

- For this purpose, you are able to borrow money from your own insurance policy.

- Generally, an insurance policy loan occurs when you either need money from your own participating plan; or when you failed to pay for the insurance premium that is due within the insurance policy’s grace period.

- It is important to realise that the insurer charges an interest rate of 5.5% to 6.75% per annum for the insurance policy loan.

- When the sum of the total outstanding loan and its accrued interest becomes larger than the insurance policy’s cash value, the insurer will terminate your insurance policy automatically.

Part 1: What is a Participating Policy

To begin with, let’s understand the basics of a participating whole life insurance policy. In essence, a participating whole life insurance policy allows you to participate or share in the profits of the insurer’s participating fund. In the same way, you will also share the participating fund’s risks. For this purpose, the insurer will pool your insurance premium together with the rest of the policyholders. Thereafter, the insurer will invest this pool of money into its participating fund. All in all, the participating fund is responsible to meet its financial obligations, e.g.

- To generate a stable return in the medium to long-term;

- Issue a payout for insurance claims and to meet expenses.

Given that your participating plan is able to accumulate a policy cash value, we are able to tag a tangible value to this plan. Consequently, this explains why you are able to take on an insurance policy loan; by using your insurance policy as a collateral.

Part 2: Requirements

To sum up, there are two requirements that your insurance policy needs to fulfil in order to take up an insurance policy loan. Firstly, your insurance policy must be in-force. Secondly, it should have accumulated sufficient policy cash value. To clarify, this policy cash value refers to the guaranteed component of the insurance policy’s total cash value. Otherwise, it may not be feasible or sustainable to proceed with the loan.

At the same time, most insurers have a clause to impose the amount that you can borrow from your own insurance policy. For example, you must borrow a minimum amount of $100. Additionally, such loan and any outstanding indebtedness shall not exceed 90% of the participating plan’s net surrender value.

Part 3: Types of Insurance Policy Loan

On the whole, there are two types of insurance policy loan.

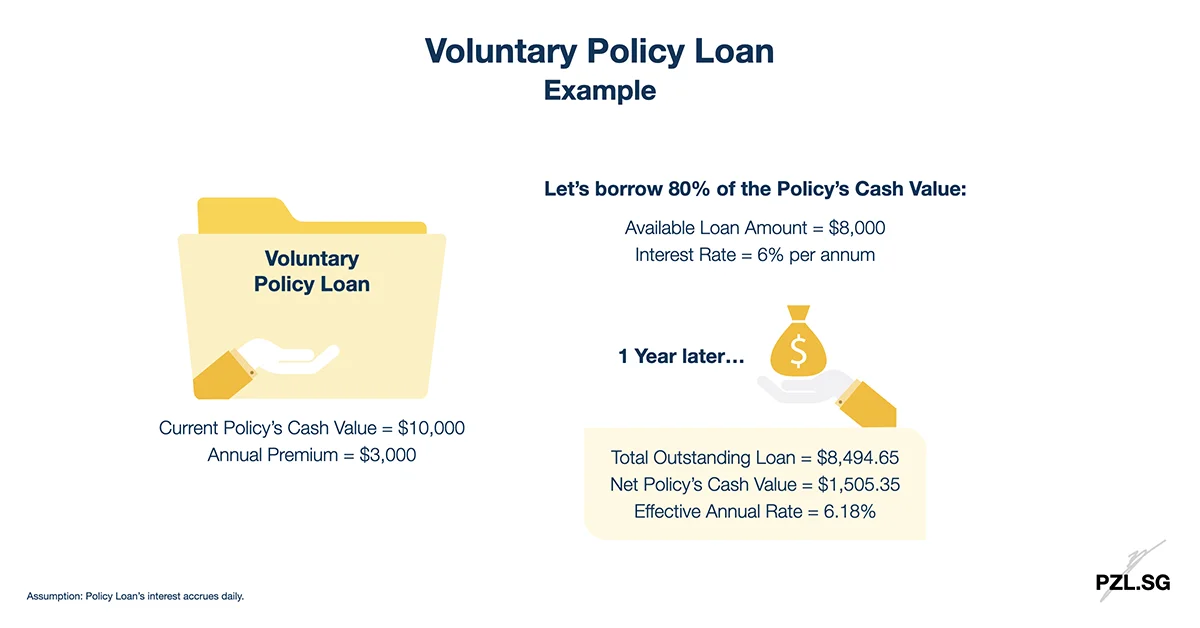

Part 3.1: Voluntary Policy Loan

Firstly, you may choose to take up an insurance policy loan on a voluntary basis. For this purpose, you may specify the amount of money that you wish to borrow from your insurance policy. In general, most insurers will allow you to borrow up to 70% or 90% of the insurance policy’s net surrender value. To illustrate, let’s assume that your insurance policy has a net surrender value of $10,000. In this case, the insurer may grant a policy loan of up to $10,000 x 90% = $9,000. After the policy loan has been granted, most insurers will either transfer the money to you via PayNow or as a direct credit into your bank account.

Meanwhile, it is important to realise that the insurer may not grant your policy loan application immediately. To point out, the insurer may decline or defer the approval of the policy loan for up to six months from the policy loan’s application date. Furthermore, the insurer may also impose additional conditions at its discretion. With this in mind, you should not take this insurance policy feature for granted.

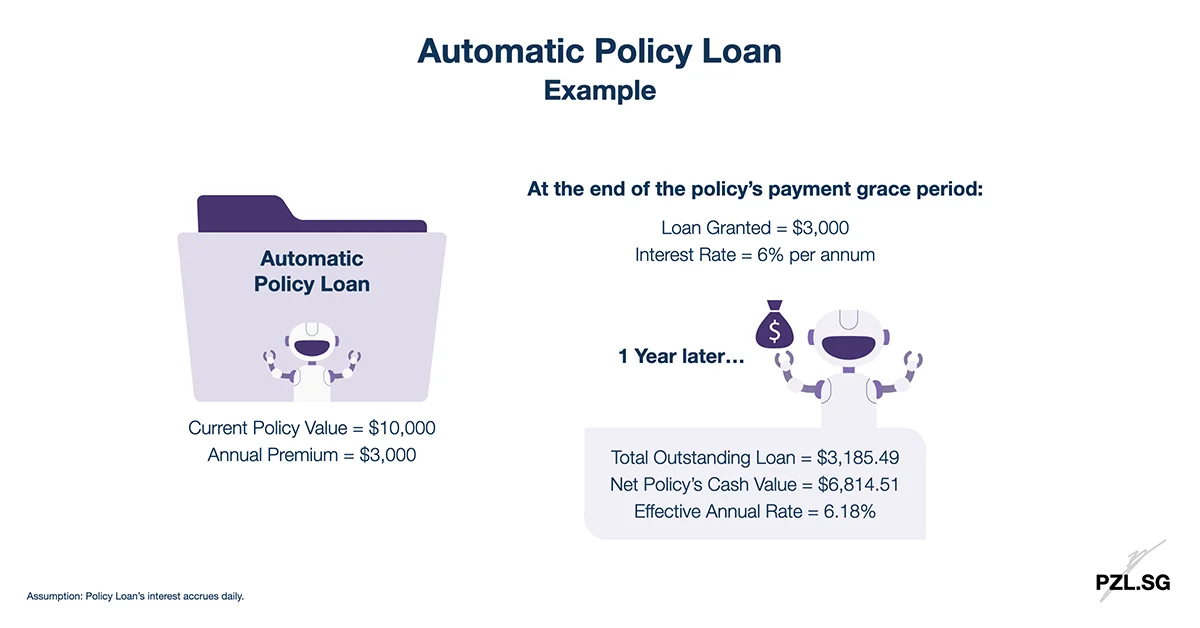

Part 3.2: Automatic Policy Loan

Secondly, the insurer may also grant an insurance policy loan to you automatically. In this case, this will usually occur when you have not paid the insurance premium that is due within the insurance policy’s grace period. To this end, so long as your insurance policy has acquired a sufficient cash value, the insurer will grant this policy loan to you automatically. For this purpose, the loan amount will be equal to the outstanding insurance premium.

Part 4: Insurance Policy Loan Interest Rate

Regardless of the type of insurance policy loan, the insurer will charge an interest for the granted loan amount. In general, this is the insurer’s practice:

- You borrow X amount from your participating plan, e.g. $10,000.

- The insurance policy loan’s interest accrues daily (in most cases).

- Finally, the interest is due either at the end of the calendar year (i.e. 31st December), or on your insurance policy’s anniversary.

Summing up, the interest will continue to accrue until the insurance policy loan is repaid in full. Furthermore, the insurer will add any unpaid interest (when it is due) to the loan principal. That is, the accrued interest will also form a part of the total amount that you need to repay the insurer. All in all, the interest will compound for both the principal and for all the unpaid interest.

At this time, this is the prevailing interest rate from some of the insurance companies in Singapore:

- AIA Singapore: 5.75% per annum

- China Taiping: 6.25% per annum

- FWD: 6.30% per annum

- Great Eastern Life: 6.00% per annum

- HSBC Life: 6.5% per annum

- Income Insurance: 5.5% per annum

- Manulife: 6.75% per annum

- Prudential: 5.75% per annum

- Singlife: 5.5% per annum

- Tokio Marine: 6.3% per annum

For this purpose, the insurance policy loan interest rate will accrue either on a daily basis or a monthly basis.

Part 5: Insurance Policy Loan Repayment

Generally, the insurer will not chase you to make a loan repayment. In fact, it is not mandatory to repay any part of the outstanding loan. Instead, you may do so at anytime and for any amount. This is so long as your insurance policy is still in-force. To this end, you may make a partial or a full repayment for the accrued interest, and/or for the principal loan. After you have make the repayment, the insurer will deduct the repaid amount from the outstanding loan.

In the event of pre-mature death, the insurer will deduct the outstanding loan from the insurance policy’s death benefit first. Thereafter, the insurer will pay the remaining balance to your beneficiaries or your estate (depends on whether you have made an insurance nomination).

Similarly, in the case of Total & Permanent Disability, or Critical Illness, the insurer will also deduct the outstanding loan from the insurance policy’s benefit first. Thereafter, you will receive the remaining balance of the benefit.

Part 6: Termination

Obviously, the insurance policy loan cannot continue perpetually. In the event that the sum of the total outstanding loan and its accrued interest becomes larger than the insurance policy’s cash value, the insurer will terminate your insurance policy automatically.

Part 7: Should You take up an Insurance Policy Loan

All things considered, an insurance policy loan provides a flexible channel for you to borrow money. After all, the insurer doesn’t mandate that you must repay the loan within a stipulated period of time. In fact, because of such a flexibility, some of the policyholders forget to repay their insurance policy loan. And by the time they realised this situation, the outstanding loan has inflated to a relatively large amount already.

As an illustration, let’s assume that you borrow $10,000 from your insurance policy. For this purpose, the insurer charges an interest rate of 6% per annum. After a decade, the total outstanding loan with interest becomes $18,220.29. As can be seen, this amount is almost double of what you have taken out from your insurance policy! Therefore, you should always be wary of the effect of compound interest in an insurance policy loan.

That being said, there may be times when an insurance policy loan makes sense. For instance, you may have exhausted all other avenues to raise capital already. In this case, rather than to take on a loan with a higher interest rate elsewhere, tapping into your policy cash value may make more sense.

In any case, if you must take on an insurance policy loan, let’s do one thing together first. That is to create a feasible loan repayment strategy so that you can remind yourself to repay this loan in a structured manner. Given that clear goal in sight, you will feel more motivated and less distracted to repay this loan.

After all, you won’t want the insurer to terminate your participating plan. If not, for an endowment savings plan, you will be forced to restart the entire wealth accumulation process again. And in the case of a participating whole life insurance policy, you will likely pay a higher rate of insurance premium (since you will be much older now). Furthermore, you will need to undergo the entire medical underwriting process again. Therefore, while an insurance policy loan seems like a useful policy feature, you should still exercise your own due diligence.

First Published: 18 December 2019

Last Updated: 18 July 2024

Leave a Reply