Launched in 2020, CareShield Life is our nation’s latest severe disability income insurance scheme. In essence, it provides a monthly cash payout if you become severely disabled. Moreover, this payout will continue, as long as you are unable to perform at least three Activities of Daily Living (ADLs). With this in mind, let’s learn more about how CareShield Life works in Singapore.

CareShield Life will undergo a series of enhancements in 2026 and I will update this post in due time. Meanwhile, here is what you need to know and how it affects you: CareShield Life Changes 2026

Table of Contents:

- What is CareShield Life

- Insurance Coverage (Benefits)

- Cash Value

- Insurance Premium (Cost)

- Limitations and Risks

- Claims

- Insurance Nomination

- Eligibility

- CareShield Life vs ElderShield

- Final Thoughts

- Trivial

One Minute Summary:

- Commenced on 1 October 2020, CareShield Life is our nation’s latest severe disability income insurance scheme.

- CareShield Life provides a monthly cash payout for as long as you remain severely disabled, i.e. inability to perform at least three of the six Activities of Daily Living.

- You may use the savings in your CPF MediSave Account to pay the insurance premium.

- You will need to pay the insurance premium till age 67 or for 10 years, whichever is later. Thereafter, you will enjoy lifetime coverage.

Part 1: What is CareShield Life

CareShield Life is a non-participating long-term care insurance policy. It is designed to provide income protection in the event of severe disability. Since it is administered directly by the Central Provident Fund Board, there is no distribution cost for this insurance policy. This makes CareShield Life a cost-efficient insurance policy for us.

Part 2: Insurance Coverage (Benefits)

Part 2.1: Main Benefits

CareShield Life provides a monthly cash payout in the event that you become and remain severely disabled. This payout will continue for as long as you cannot perform three or more Activities of Daily Living. The six Activities of Daily Living are:

- Dressing;

- Feeding;

- Mobility;

- Transferring;

- Toileting;

- Washing.

With a cash payout, you have the flexibility to decide how to utilise it. For example, you may hire a helper or a trained caregiver for home care, or to pay for the cost of staying in a nursing home.

Part 2.2: Coverage Amount

- The starting monthly payout was $600 in 2020.

- Between 2020 and 2025, the monthly payout increases by 2% annually. For example, if you make your first claim in 2025, you will receive a monthly payout of $662.

- Between 2026 to 2030, the monthly payout will increase by 4% annually.

Once you turn 67 or make a successful claim, the payout amount is locked in and will no longer increase. If you become disabled after age 67, the payout will be based on the amount when you turned 67.

Part 2.3: Coverage Period

Similar to MediShield Life, CareShield Life provides lifelong insurance coverage for as long as you live.

Part 3: Cash Value

As a non-participating long-term care insurance policy, CareShield Life does not accumulate any cash value. Consequently, you cannot surrender this Plan for a surrender value. Instead, you will receive a payout from the insurance policy only when you become severely disabled.

Part 4: Insurance Premium (Cost)

Part 4.1: Premium Determinants

Generally, the insurance premium is determined based on your age and gender.

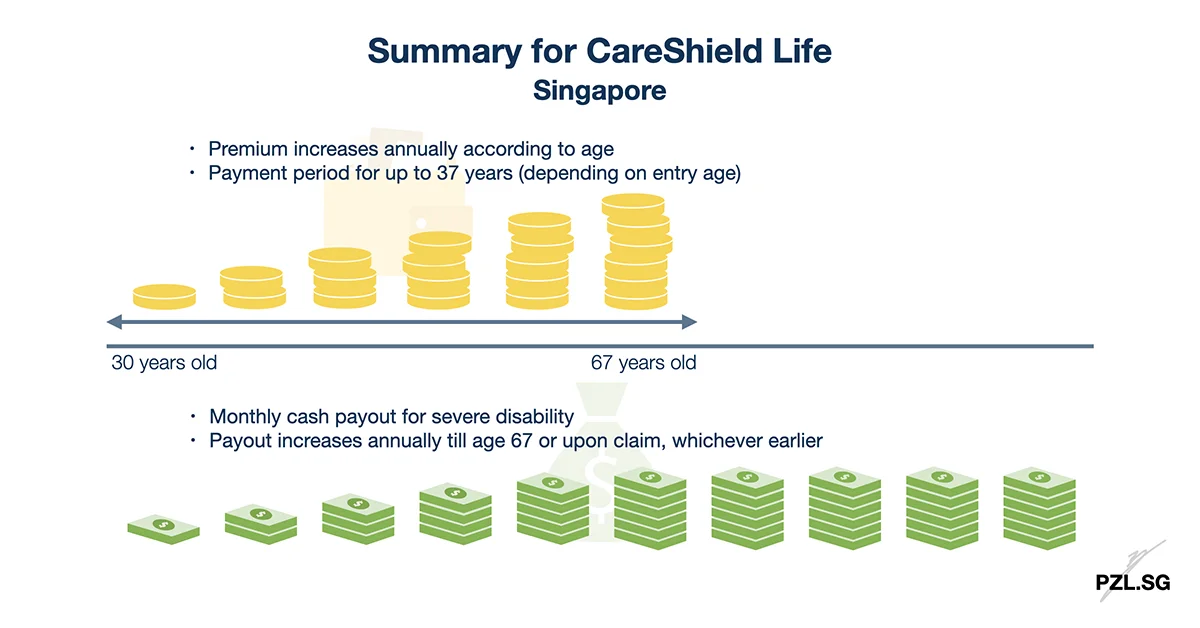

Part 4.2: Non-Guaranteed Escalating Premium Rates

Between 2020 and 2025, the insurance premium rate will increase by 2% per annum. To illustrate,

- For a male life insured, the annual premium starts at $206 (age 30 in 2020) and may increase up to $1,619 (age 67).

- For a female life insured, the annual premium starts at $253 (age 30 in 2020) and may increase up to $2,178 (age 67).

In 2026, there will be a one-step increase in the insurance premium. Thereafter, between 2026 to 2030, the insurance premium rate will increase by 4% per annum. In absolute terms, the average annual increase is $38, up to $75 each year.

Presently, the Government offers subsidies and support to keep the insurance premium affordable.

- Means-tested Premium Subsidies: Up to 30% subsidies for lower- to middle-income Singapore residents.

- Participation Incentives: Up to $4,000 over 10 years for Singapore Citizens born in 1979 or earlier and are covered before 31 December 2024.

- Additional Premium Support (APS): Extra help for those who cannot afford the insurance premium even after the premium subsidy and family support.

Above all, no Singaporean will lose their CareShield Life coverage due to their inability to afford the insurance premium.

Part 4.3: Premium Paying Period

The payment duration depends on your age:

- Below age 59: Pay until age 67.

- Age 59 and above: Pay for a period of 10 years from enrolment.

After you have completed the premium paying period, you will be insured for the rest of your life.

Part 4.4: Premium Waiver

If you are severely disabled on the date when the insurance premium is due, you do not need to pay the premium. However, if you are no longer severely disabled, then you will need to resume the premium payment.

Part 4.5: Distribution Cost

Since CareShield Life is administered directly by the CPF Board, there is no distribution cost. Like MediShield Life, CareShield Life works on a risk-pooling model – the insurance premiums collected from your generation are pooled to pay claims.

Part 5: Limitations and Risks

Part 5.1: Waiting Period

There is no waiting period and the insurance coverage starts immediately upon enrolment.

Part 5.2: Deferment Period

Contractually, there is a 90-day deferment period from the date of the disability assessment. This ensures that the disability is of a long-term nature before CareShield Life’s payout begins. However, in most cases, the Government waives the deferment period to enable faster payouts. Nonetheless, the deferment period may be imposed in situations where the disability status is ambiguous.

Part 5.3: Free-Look Period

- Born in 1980 or later: CareShield Life is a mandatory scheme for you. This means you won’t be able to opt out or to exercise the free-look option.

- Born in 1979 or earlier: You may opt out within the 60-day free-look period that starts from the insurance policy’s commencement date.

Part 5.4: Grace Period

Grace period is not applicable since the Government assures that no one will lose coverage due to an inability to pay the insurance premium.

Part 5.5: Exclusion

There are no exclusions under this insurance policy. Instead, you are covered regardless of any pre-existing medical conditions or disabilities.

Part 6: Claims

A MOH-accredited severe disability assessor will assess whether you require full assistance for at least three of the six Activities of Daily Living. The first assessment is free, and this is regardless of whether you are assessed to be severely disabled or not. For subsequent assessments, the assessor will collect

- $100 if you visit an assessor’s Clinic;

- $250 if an assessor visits your home.

This assessment fee will be reimbursed if you are assessed to be severely disabled.

Part 7: Insurance Nomination

CareShield Life does not provide any death benefit. Hence, insurance nomination does not apply.

Part 8: Eligibility

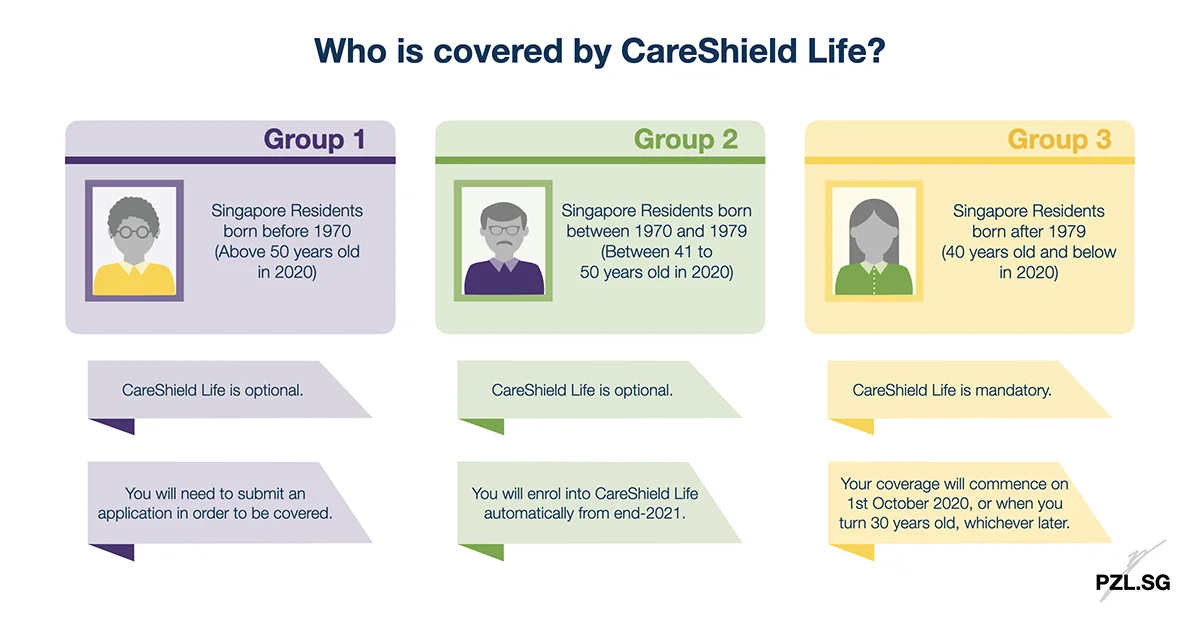

All Singapore Citizens and Permanent Residents are eligible to join CareShield Life. Your eligibility depends on your year of birth:

Group 1: Born before 1970 (Above 50 years old in 2020)

If you are born before 1970, participation in CareShield Life is optional. To join, you may complete a disability declaration and submit an application via CPF’s website. Your enrolment will depend on the underwriting outcome. Once your coverage commences, you will enjoy a 60-day free-look period. Thereafter, you will not be allowed to terminate your CareShield Life cover.

For foreigners who become Singapore Citizens or Permanent Residents after 1 October 2020, enrolment is mandatory unless you are already severely disabled.

Group 2: Born between 1970 and 1979 (Between the ages of 41 to 50 years old in 2020)

If you are currently

- Insured under ElderShield 400; and

- Not severe disabled,

You will enrol into CareShield Life automatically from 1 December 2021. Despite the automatic enrolment, you may choose to opt out by 31 December 2023.

Group 3: Singapore Residents born after 1979 (40 years old and below in 2020)

Regardless of whether you have any pre-existing medical conditions or disabilities, you will be automatically enrolled into CareShield Life

- From 1 October 2020, or

- Upon turning 30, whichever is later.

Depending on your enrolment period, you will receive a welcome letter with your policy details:

- Between 30 to 40 years old in 2020: You will receive a notification letter between September 2020 to October 2020.

- Below 30 years old in 2020: You will receive a notification letter about two months before your 30th birthday.

Part 9: CareShield Life vs ElderShield

Introduced in 2002, ElderShield was the predecessor to CareShield Life. Here is a quick comparison between the two severe disability insurance schemes:

| Feature | ElderShield 300 | ElderShield 400 | CareShield Life |

|---|---|---|---|

| Type of Insurance | Severe Disability | Severe Disability | Severe Disability |

| Claim Condition | Inability to perform 3 or more ADLs | Inability to perform 3 or more ADLs | Inability to perform 3 or more ADLs |

| Coverage Type | Level | Level | Increases at 2% annually (from 2020 to 2025) |

| Coverage Amount | $300 | $400 | Starts from $600 in 2020 |

| Coverage Duration | Up to 60 months | Up to 72 months | Lifetime |

| Premium Term | To Age 65 | To Age 65 | To Age 67 |

| Premium Frequency | Annually | Annually | Annually |

| Premium Mode | CPF MediSave | CPF MediSave | CPF MediSave |

Summing up, CareShield Life offers both escalating and higher monthly payouts for life. This provides a stronger medical safety net as compared to ElderShield.

Part 10: Final Thoughts

According to the Ministry of Health in 2018, 1 in 2 Singaporeans who are healthy at age 65 could become severely disabled at some point in their lifetime and require long-term care support. Moreover, there is also an uncertainty about the duration a person remains severely disabled. Although the median duration of disability is four years, 30% of people could remain severely disabled for 10 years or more.

In my opinion, planning for old age isn’t just about saving for retirement. At the same time, it is also about creating a robust medical safety net in the event that you require additional support for daily living.

As our national severe disability insurance scheme, CareShield Life sets the foundation by offering lifetime coverage, and an escalating payout. This is backed by the Government’s assurance where no one will lose this coverage due to an inability to afford the insurance coverage.

That being said, one question remains – is CareShield Life sufficient to meet your long-term care needs? Well, in general, this depends on your preferred lifestyle and the level of family support available. If you want a payout on top of CareShield Life, then you may wish to consider a private supplement. An example would be Income Insurance’s Care Secure Pro.

Part 11: Trivial

The Central Provident Fund (CPF) Board and Agency for Integrated Care (AIC) administer the CareShield Life. Additionally, they also administers ElderShield when it was transferred to the Government in 2021. Overall, the CareShield Life Council will oversee both long-term care insurance schemes and make recommendations on policy and scheme parameters. This includes premium and benefit adjustments to ensure these schemes provide effective protection for everyone.

First Published: 9 September 2020

Last Updated: 12 November 2025

Reference:

CareShield Life and Long-Term Care Bill (Bill No. 24/2019)

Leave a Reply