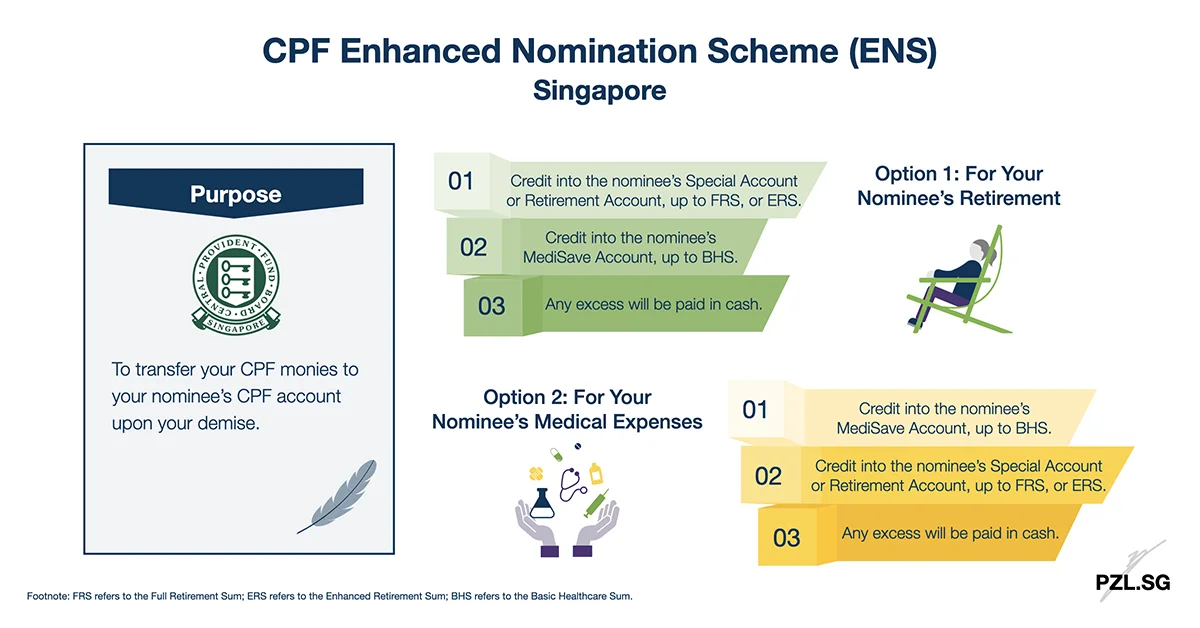

In essence, the CPF Enhanced Nomination Scheme (“ENS”) allows you to distribute your CPF monies to your beneficiaries’ CPF account upon your demise. To explain, this is one of the three ways to distribute your CPF monies to your intended beneficiaries. Given that sizeable amount that you will accumulate during your working years, you won’t want it to fall into the wrong hands. With this in mind, let’s find out how the Enhanced Nomination Scheme works in Singapore.

Table of Contents:

- What is CPF Enhanced Nomination Scheme?

- Who is eligible?

- Transfer Options

- How to sign up for the Enhanced Nomination Scheme?

- Conclusion

One Minute Summary:

- Upon your demise, CPF Enhanced Nomination Scheme (“ENS”) allows you to distribute your CPF monies to your nominee’s CPF account.

- It is important to realise that your nominees will be able to use these monies for their retirement needs only.

- On the whole, a CPF nomination is the only way to distribute your CPF monies according to your wishes.

Part 1: What is CPF Enhanced Nomination Scheme?

As I have noted earlier, CPF Enhanced Nomination Scheme allows you to transfer your CPF monies to your nominees’ CPF account upon your demise. This is as compared to the default cash option, i.e. your nominees receive your CPF monies in cash.

Part 1.1: Retirement Needs only

It is important to realise that you will be setting aside your CPF monies for your nominees’ retirement needs only. In detail, these monies can only be used for monthly payouts under the Retirement Sum Scheme, or CPF LIFE.

In other words, your nominees will not be able to withdraw these monies for other purposes, e.g. housing, investment, or education. Furthermore, your nominees cannot withdraw these monies even if they have a property with sufficient CPF property charge or pledge.

Part 1.2: How long will the process take?

Generally, CPF Board will complete the transfer within one month after the notification of your death.

Part 2: Who is eligible?

All in all, all CPF members can submit an Enhanced Nomination Scheme so long as the nominee is

- a Singapore Citizen; or

- a Singapore Permanent Resident.

Part 2.1: What if the nominee is no longer a Singapore Citizen, or Singapore Permanent Resident at the time of disbursement?

In this situation, your nominee will receive the bequeathed CPF monies in cash.

Part 2.2: Can I split the distribution between cash and CPF transfer?

Same Nominee

For this purpose, you can only choose one type of distribution. For example, you cannot choose to distribute 50% via CPF transfer, and the other 50% in cash to the same nominee.

Different Nominees

Notwithstanding that, you may choose to distribute cash to the first nominee and via a CPF transfer to the second nominee.

Part 3: Transfer Options

Altogether, there are two transfer options to choose from. By and large, this depends on your priority.

Part 3.1: Option 1 – For Your Nominee’s Retirement

Firstly, you may choose to credit your CPF monies into your nominee’s Special Account or Retirement Account first. In detail, you can credit up to the current Full Retirement Sum, or Enhanced Retirement Sum.

For CPF Members whose 55th birthday is in 2021:

- Full Retirement Sum (FRS): S$186,000

- Enhanced Retirement Sum (ERS): S$279,000

After the transfer has reached its limit, CPF will transfer the remainder into your nominee’s Medisave Account. In like manner, you can credit up to the Basic Healthcare Sum.

For CPF Members whose 65th birthday is in 2021:

- Basic Healthcare Sum (BHS): S$63,000

Thereafter, your nominee will receive the remaining balance (if any) in cash.

Part 3.2: Option 2 – For Your Nominee’s Medical Expenses

By comparison, you may choose to credit your CPF monies into your nominee’s Medisave Account first. In similar fashion, you can transfer up to the Basic Healthcare Sum.

After the transfer has reached its limit, CPF will transfer the remainder into your nominee’s Special Account, or Retirement Account. Likewise, you can transfer up to the Full Retirement Sum, or Enhanced Retirement Sum.

Finally, your nominee will receive cash for the remaining balance.

In any case, it must be remembered that all crediting and payment processes are subjected to the prevailing CPF rules.

Part 4: How to sign up for the Enhanced Nomination Scheme?

For this purpose, you may make an appointment to visit any of the five CPF Service Centres in Singapore.

- Bishan Service Centre;

- Jurong Service Centre;

- Maxwell Service Centre;

- Tampines Service Centre;

- Woodlands Service Centre.

Thereafter, the customer service executive will guide you to complete the Enhanced Nomination form. What’s more, they can act as the witnesses for your nomination, and to answer any questions that you may have.

Part 5: Conclusion

If you prefer to transfer your CPF monies into your nominee’s CPF account, then submit an Enhanced Nomination Scheme form. Otherwise, the CPF Cash Nomination will be the default option. In any case, I will strongly urge you to complete a CPF Nomination. This is because we cannot distribute our CPF monies through a Will. Above all, don’t leave it to the state to decide how to distribute your assets.

Checklist:

- Have you made a CPF Nomination?

- Which will you choose – Cash Nomination or Enhanced Nomination?

- How do you plan your estate?

First Published: 20 November 2019

Last Updated: 23 February 2021

Leave a Reply