Launching in January 2026, the Matched MediSave Scheme (MMSS) is a targeted government initiative designed to help Singaporeans aged 55 to 70 strengthen their medical safety net. Similar to the existing Matched Retirement Savings Scheme (MRSS), the MMSS offers a dollar-for-dollar government grant for eligible cash top-ups made to your MediSave Account. In this article, we examine the mechanics of the MMSS, the eligibility criteria, and how this scheme fits into your broader healthcare and retirement planning.

🎥 Prefer watching? Check out the video version of this post.

Table of Contents:

- What is the Matched MediSave Scheme (MMSS)

- How MMSS Works

- Benefits

- Limitations

- Eligibility Criteria

- Practical Examples

- MMSS vs MediSave Top-Up

- Who This is Suitable For

- How MMSS Fits into the Broader Healthcare Ecosystem

- Final Thoughts

One Minute Summary:

- What It Is: A government scheme that matches eligible cash top-ups to your CPF MediSave Account dollar for dollar.

- Key Eligibility Criteria: You must be a Singapore Citizen aged 55 to 70, with a MediSave balance below 50% of the Basic Healthcare Sum ($39,500 in 2026).

- The Benefit: You can receive matching grants of up to $1,000 per year (Total $5,000 over 5 years).

- The Trade-Off: Cash top-ups that receive the matching grant are not eligible for tax relief.

- No Application Needed: Eligibility is automatically assessed annually. If you qualify, the CPF Board will notify you via email or post.

Part 1: What is the Matched MediSave Scheme (MMSS)

The Matched MediSave Scheme (MMSS) is a five-year initiative running from 2026 to 2030. Its primary objective is to help eligible seniors, particularly those with lower MediSave balances, build a more robust reserve for future medical expenses.

The concept is simple: If you qualify, for every dollar you contribute to your MediSave Account, the Singapore Government contributes another dollar, up to the annual cap.

It is important to understand that the Matched MediSave Scheme is strictly a healthcare savings scheme. All funds remain in the MediSave Account and can only be used to pay for approved medical purposes such as:

- Hospitalisation and Treatments: Inpatient bills, day surgeries, and selected costly outpatient treatments

- Health Insurance: Premiums for MediShield Life and Integrated Shield Plans

- Long-Term Care: Residential long-term care services, and premiums for ElderShield, CareShield Life, and their respective supplements

Part 2: How MMSS Works

The process is designed to be frictionless and largely automated.

Part 2.1: Eligibility Assessment

At the beginning of each year (starting from January 2026), the CPF Board (CPFB) automatically assesses your eligibility. You do not need to apply manually. If you qualify, CPF Board will notify you via email or post.

Part 2.2: Making MediSave Contributions

Once you are confirmed as eligible, you or your family members may make cash top-ups to your MediSave Account.

To qualify for the matching grant:

- The top-ups must be made in cash

- Top-ups must be made by 31 December of the assessment year

- Contributions can be a lump sum or multiple smaller amounts throughout the year

The structure allows flexibility in timing, as long as the annual cap is respected.

Part 2.3: Receiving the Matching Grant

The Government will match your contribution by crediting the grant to your MediSave Account at the start of the following year. For example, cash top-ups made in 2026 will receive the matching grants in early 2027.

Part 2.4: Interest Accumulation

Your cash top-ups begin earning interest immediately upon being credited. Both your own contribution and the eventual government grant earn the risk-free CPF interest rate of at least 4% per annum. This interest accrues from the moment of contribution, regardless of when the matching grant is credited.

Part 3: Benefits

Part 3.1: Government Matching Grant

Under MMSS, the Government matches your contribution dollar-for-dollar up to $1,000 per year.

For example, if you top up $1,000 in 2026, the Government will credit another $1,000 to your MediSave Account in early 2027. This represents an immediate 100% return on your contribution, before interest is even factored in. Over the scheme’s five-year duration, you can receive up to $5,000 in matching government grants.

Part 3.2: High Risk-Free Interest

MediSave savings earn a base risk-free interest rate of 4% per annum. Additionally, CPF pays extra interest on the first $60,000 of your combined balances.

| Age | Base Interest (Per Annum) | Additional Interest (Per Annum) | Total Interest (Per Annum) |

|---|---|---|---|

| Below 55 | 4% | 1% on the first $60,000 combined CPF balances, capped at $20,000 for OA | Up to 5% |

| 55 and above | 4% | 2% on the first $30,000, and 1% on the next $30,000 combined CPF balances, capped at $20,000 for OA | Up to 6% |

This is among the highest risk-free returns in Singapore. When combined with the matching grant, the compound effect is substantial.

Part 3.3: A Stronger Medical Safety Net

By boosting your MediSave balance, you strengthen your ability to pay for essential insurance premiums like MediShield Life and CareShield Life. This provides peace of mind against inflation and healthcare risks.

Part 3.4: Flexibility in Contribution

CPF top-ups may be made at any time during the year, either as a lump sum or spread across multiple months. Both approaches qualify for matching. This is as long as the total eligible amount does not exceed the annual cap.

That said, contributing earlier may be advantageous. This is because CPF calculates the interest on a monthly basis. A January top-up earns interest for almost the full year, whereas a December top-up earns substantially less interest in that year. This difference compounds over time.

Part 4: Limitations

While the benefits are clear, it is important to understand the constraints.

Part 4.1: Top-Up Limits

Only the first $1,000 of MediSave top-ups each year is eligible for matching.

For example, if you top up $8,000:

- The first $1,000 receives the matching grant.

- The remaining $7,000 does not.

The MMSS runs for five years, ending in 2030.

Part 4.2: No Tax Relief on Matched Amounts

Cash top-ups that attract the MMSS matching grant are not eligible for tax relief.

However, top-ups beyond the MMSS-matched amount may still qualify for tax relief under the prevailing MediSave Top-Up rules.

For example, if you top up $8,000:

- The first $1,000 receives MMSS matching (no income tax relief)

- The remaining $7,000 may qualify for income tax relief).

This structure prevents claiming both matching grants and tax relief on the same contribution.

Part 4.3: Liquidity Lock-In

Cash top-ups to MediSave are irreversible. Once contributed, you cannot

- Withdraw the funds as a lump sum

- Use them for non-medical expenses

- Transfer them to loved ones.

These funds are permanently committed to funding your future medical expenses. This restriction exists because top-ups enjoy higher interest and tax benefits. Allowing withdrawals would defeat the purpose of saving up for your future medical needs.

Before topping up, consider whether you:

- Need liquidity for emergencies or near-term expenses

- Expect to require a lump sum in retirement

- Want to preserve funds for legacy planning

- Have sufficient cash savings outside CPF

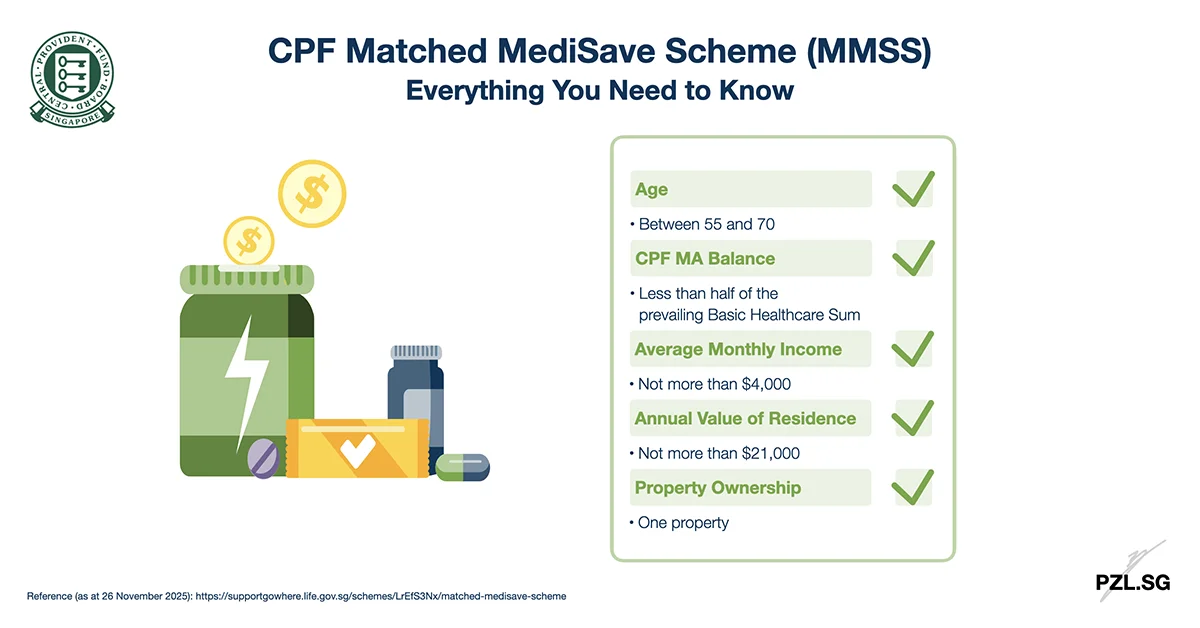

Part 5: Eligibility Criteria

To qualify for the MMSS, you must meet all the following criteria as of 31 December of the assessment year:

- Citizenship: Singapore Citizen

- Age: Between Age 55 and 70 (inclusive)

- MediSave Balance: Less than half of the prevailing Basic Healthcare Sum (e.g., less than $39,500 in 2026)

- Income: Average monthly income of $4,000 or less

- Housing: Lives in a property with an Annual Value of $21,000 or less

- Property Ownership: Does not own more than one property

Part 6: Practical Examples

Let’s look at two scenarios to see how the math works in real life.

Part 6.1: Example 1 – The “Sandwiched” Homemaker

Profile of Member A:

- Singapore Citizen

- Age 60

- MediSave Account Balance: $12,000

- Average Monthly Income: $0

- Lives in a 4-room HDB flat (Annual Value is less than $21,000)

- Owns only 1 property

Member A (or his family members on her behalf) makes a cash top-up of $1,000 to his MediSave Account.

The Outcome:

- Matching Grant: The Government credits another $1,000 to Member A’s MediSave Account in early 2027.

- Updated MediSave Balance: Becomes $14,000, before CPF interest.

- Tax Relief: This contribution of $1,000 is not eligible for tax relief.

If Member A wishes to enjoy tax relief, he can top up an additional amount, say $3,000. In this case,

- The first $1,000 attracts MMSS matching (no tax relief).

- The additional $3,000 may qualify for tax relief under the MediSave Top-Up rules.

Part 6.2: Example 2 – Part-Time Gig Worker

Profile of Member B:

- Singapore Citizen

- Age 65

- MediSave Account Balance: $25,000

- Average Monthly Income: $2,000

- Lives in a 3-room HDB flat (Annual Value is less than $21,000)

- Owns only 1 property

Member B, or his family members, makes a monthly cash top-up of $100 to his MediSave Account for 12 months, totalling $1,200.

The Outcome:

- Matching Grant: The Government credits another $1,000 to Member B’s MediSave Account in early 2027.

- Updated MediSave Balance: Becomes $27,200, before CPF interest.

- Tax Relief: The first $1,000 attracts the MMSS matching grant and is not eligible for tax relief. The remaining $200 is eligible for tax relief under the standard MediSave Top-Up rules.

Member B can perform additional cash top-ups if he wishes to enjoy even more tax relief beyond MMSS.

Part 7: MMSS vs MediSave Top-Up

Generally, you can view the MMSS as a “bonus tier” layered on top of the standard MediSave Top-Up scheme.

Part 7.1: Key Differences between MMSS and MediSave Top-Up

| Feature | MMSS | MediSave Top-Up |

|---|---|---|

| Primary Benefit | Government matching grant | Income tax relief |

| Who Provides the Benefit | Government | IRAS |

| Annual Cap | $1,000 | Up to the prevailing Basic Healthcare Sum |

| Tax Relief | No | Yes, subject to RSTU rules |

| Eligibility Criteria | Strict | Broad |

| Top-Up Method | Cash only | Cash only |

Part 7.2: How MMSS and MediSave Top-Up Work Together

If you qualify for MMSS and make a cash top-up, the first $1,000 of eligible top-up falls under the MMSS. This portion

- Receives government matching, and

- Does not qualify for tax relief.

Any top-up beyond $1,000 falls under the standard MediSave Top-Up. This portion

- Does not receive government matching, and

- May qualify for tax relief, subject to the usual MediSave Top-Up rules.

MMSS and the standard MediSave-Up Top-Up are complementary, but the same dollar cannot receive both benefits.

Part 7.3: When MMSS matters more

Generally, MMSS is more relevant if:

- You meet the strict eligibility criteria

- Your priority is to boost your healthcare savings

- You are comfortable with locking in your cash savings

For illustration, assuming a 24% marginal tax rate:

- $1,000 tax relief saves you $240 in taxes

- $1,000 MMSS matching adds $1,000 directly to your MediSave balance

Therefore, consider maximising the MMSS benefit first before making additional top-ups for tax relief purposes.

Part 7.4: When the standard MediSave Top-Up matters more

Conversely, the standard MediSave Top-Up is more relevant if you:

- Do not qualify for MMSS

- Are still accumulating CPF towards the Basic Healthcare Sum

- Place higher value on immediate tax relief

MediSave Top-Up remains the primary CPF top-up mechanism for higher-income earners or those who have already exhausted the MMSS benefits.

Part 8: Who This is Suitable For

The Matched MediSave Scheme is suitable for:

- Homemakers and Caregivers: Aged 55 to 70 with limited CPF contributions

- Adult Children: Supporting parents with low MediSave balances

- Pre-Retirees: Seeking to stabilise healthcare funding while cash flow is available

However, the MMSS may be less suitable for those who:

- Require short-term liquidity

- Focus primarily on investment returns

- Have minimal anticipated healthcare needs

Part 9: How MMSS Fits into the Broader Healthcare Ecosystem

The CPF Matched MediSave Scheme is one piece of Singapore’s multi-layered healthcare financing system. Here is how it fits:

| Layer | Purpose | Who Pays |

|---|---|---|

| MediSave | Savings for medical and long-term care | You (via CPF contributions or voluntary top-ups) |

| MediShield Life | Basic healthcare insurance | You (via savings in MediSave) |

| Integrated Shield Plan | Additional private health insurance coverage | You (optional, premiums from MediSave + cash) |

| MediFund | Last-resort safety net | Government |

| CPF Matched MediSave Scheme | Boosting MediSave via co-contribution | You + Government |

MMSS strengthens the system at the savings layer. It ensures you can meet future healthcare costs without excessive reliance on safety nets.

Part 10: Final Thoughts

The Matched MediSave Scheme (MMSS) is a preventive policy. It encourages seniors to build sufficient medical reserves so that healthcare and insurance costs do not unduly erode retirement income.

The eligibility criteria are narrow by design. However, for those who qualify, the benefits are tangible. If you do not qualify, the broader lesson remains unchanged: healthcare planning is personal, layered, and long-term.

Finally, a resilient healthcare plan does not depend on a single scheme. It aligns savings, insurance coverage, and realistic expectations over time.

Reference: Matched MediSave Scheme

Leave a Reply