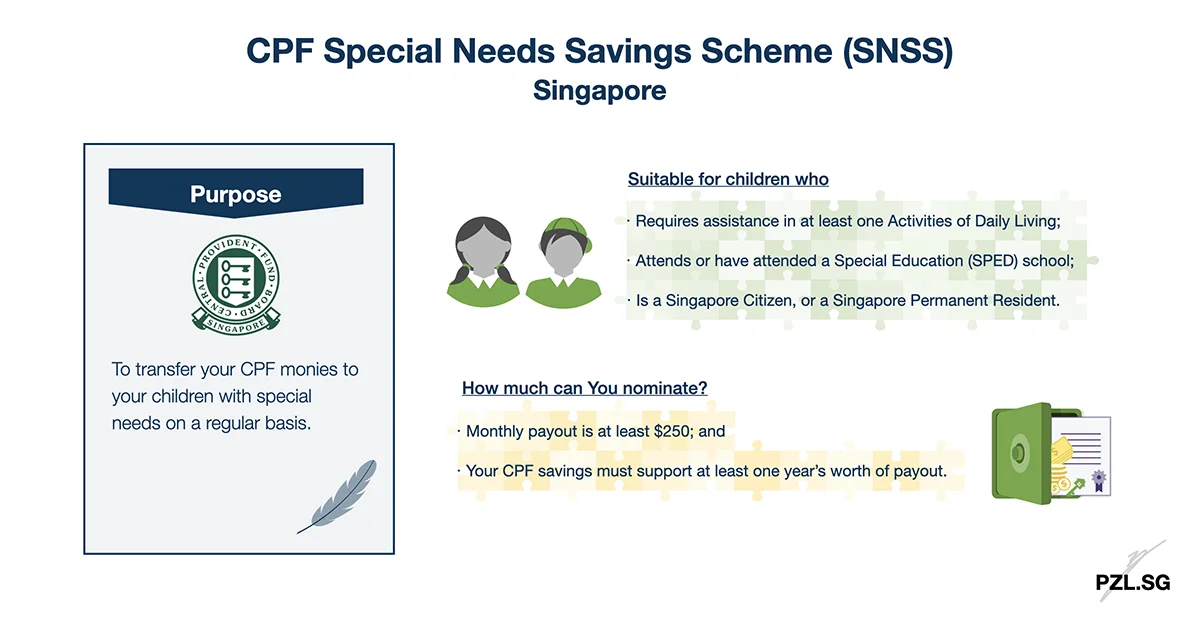

In essence, the CPF Special Needs Savings Scheme (“SNSS”) allows you to distribute your CPF monies to your children with special needs on a regular basis. To sum up, this is one of the three ways to distribute your CPF monies to your intended beneficiaries. Given that need for consistent long-term care, SNSS provides some form of financial certainty for your child. With this in mind, let’s find out how the Special Needs Savings Scheme works in Singapore.

Table of Contents:

- What is CPF Special Needs Savings Scheme (SNSS)?

- Who is eligible?

- How does it work?

- How to sign up for Special Needs Savings Scheme?

- Conclusion

One Minute Summary:

- Upon your demise, CPF Special Needs Savings Scheme (“SNSS”) allows you to disburse your CPF monies to your child with special needs on a monthly basis.

- For this purpose, you will need to obtain a certification from Special Needs Trust Company (SNTC).

- On the whole, a CPF nomination is the only way to distribute your CPF monies according to your wishes.

Part 1: What is CPF Special Needs Savings Scheme (SNSS)?

To explain, the Ministry of Social and Family Development has collaborated with CPF Board to develop the Special Needs Savings Scheme. Accordingly, you can set aside a portion (or all) your CPF savings for the long-term care of your child with special needs. Upon your demise, your child will receive a monthly payout (rather than the usual lump sum payout).

At this time, the Special Needs Trust Company (SNTC) administers the Special Needs Savings Scheme.

Part 1.1: Who is Special Needs Trust Company (SNTC)?

Special Needs Trust Company (SNTC) is a non-profit trust company with a Charity and Institute of Public Character status. To that end, it is able to provide affordable trust services for persons with disabilities. In detail, Special Needs Trust Company partners with the Public Trustee Office to manage and invest the trust funds. Above all, the government guarantees the principal value of these funds.

Part 2: Who is eligible?

Part 2.1: Nominating Applicant

For this purpose, you should be

- The parent or the appointed legal guardian of the child with special needs; and

- Singapore Citizen, or Singapore Permanent Resident.

Part 2.2: Nominee

Next, the child should

- Require assistance in at least one Activities of Daily Living (i.e. Dressing, Feeding, Mobility, Toileting, Transferring, Washing);

- Attend or have attended a Special Education (SPED) school;

- Be a Singapore Citizen, or a Singapore Permanent Resident.

Part 3: How does it work?

Part 3.1: How much can you nominate?

By and large, you may decide the amount of monthly payout to give to your child upon your demise. Summing up, this payout will last till your CPF balance gets exhausted completely.

For one thing, you may nominate any number of eligible children under this scheme. In like manner, both parents may nominate their respective CPF savings to the same child. In any case, the payout must fulfil the following two conditions:

- Firstly, the monthly payout is at least $250 for each nominated child. Of course, you may decide on a higher amount.

- Secondly, your CPF savings (upon your demise) must be able to support a year’s worth of payout.

Otherwise, your nominee will receive the payout in a lump sum.

Part 3.2: How will your Child receive the money?

To demonstrate, there are three scenarios – depending on your child’s age and mental capacity.

Part 3.2.1: Nominee is below 18 years old

In this case, the nominee’s legal guardian or the court-appointed deputy will need to submit an application to CPF Board. After the approval, CPF Board will make the disbursement.

Part 3.2.2: Nominee is at least 18 years old, and of sound mind

In this situation, the nominee will receive the disbursement in his bank account.

Part 3.2.3: Nominee is at least 18 years old, and lacks mental capacity

If the nominee has made a Lasting Power of Attorney (LPA), then CPF Board will disburse the payout to the donee.

In its absence (i.e. no LPA), a third party may apply to the court to be appointed as the nominee’s deputy. Thereafter, CPF Board will make payment to the court-appointed deputy.

Part 3.3: How much does the scheme cost?

Free. To clarify, Special Needs Trust Company provides this trust service on a pro bono basis.

Part 3.4: Do You have to distribute all your CPF monies under SNSS?

No, you don’t have to distribute all your CPF monies under SNSS. In fact, you may allocate part of your CPF monies under this scheme, and distribute the remainder via a cash nomination or an enhanced nomination scheme.

Part 3.5: Can You make adjustments to an existing SNSS?

Yes you can alter the amount of monthly payout or its duration. For this purpose, you may submit another CPF Special Needs Savings Scheme nomination form. I will elaborate on the application process in detail in the next section.

Part 4: How to sign up for Special Needs Savings Scheme?

Altogether, there are two steps to complete.

Part 4.1: Obtain a certification from Special Needs Trust Company (SNTC)

- Firstly, download and complete the application form (SNSS_V6_17JUL19.pdf).

- Next, submit the completed form to Special Needs Trust Company together with the following four documents:

Required Documents for Submission:

- Completed application form;

- Applicant’s NRIC front and back;

- Child’s NRIC and birth certificate;

- School Certification Letter or Doctor’s Assessment Report; or Functional Assessment Report.

Part 4.2: Apply for SNSS Nomination with CPF Board

After you have received a certified eligibility letter from Special Needs Trust Company, you may proceed to any of the CPF Service Centres to complete the CPF Special Needs Savings Scheme nomination.

Locations of the five CPF Service Centres in Singapore:

- Bishan Service Centre;

- Jurong Service Centre;

- Maxwell Service Centre;

- Tampines Service Centre;

- Woodlands Service Centre.

Part 5: Conclusion

All in all, CPF Special Needs Savings Scheme safeguards your children’s welfare and financial security. For the most part, we shift the guardian’s financial and legal responsibilities to a professional entity. Even in the event if the guardian falls sick or become incapable of managing your child’s financial affairs, you do not have to worry about his wellbeing.

On the other hand, you may also choose to distribute your CPF savings as a lump sum via a cash nomination or an enhanced nomination scheme.

Checklist:

- Complete your CPF nomination today.

- Draft a Will.

- Conduct a comprehensive financial portfolio review.

First Published: 11 December 2019

Last Updated: 27 April 2021

Leave a Reply