Are you aware on the upcoming changes to the critical illness definitions for your insurance policy? At this point, the insurers are using the Version 2014 definitions from the Life Insurance Association Singapore (“LIA”).

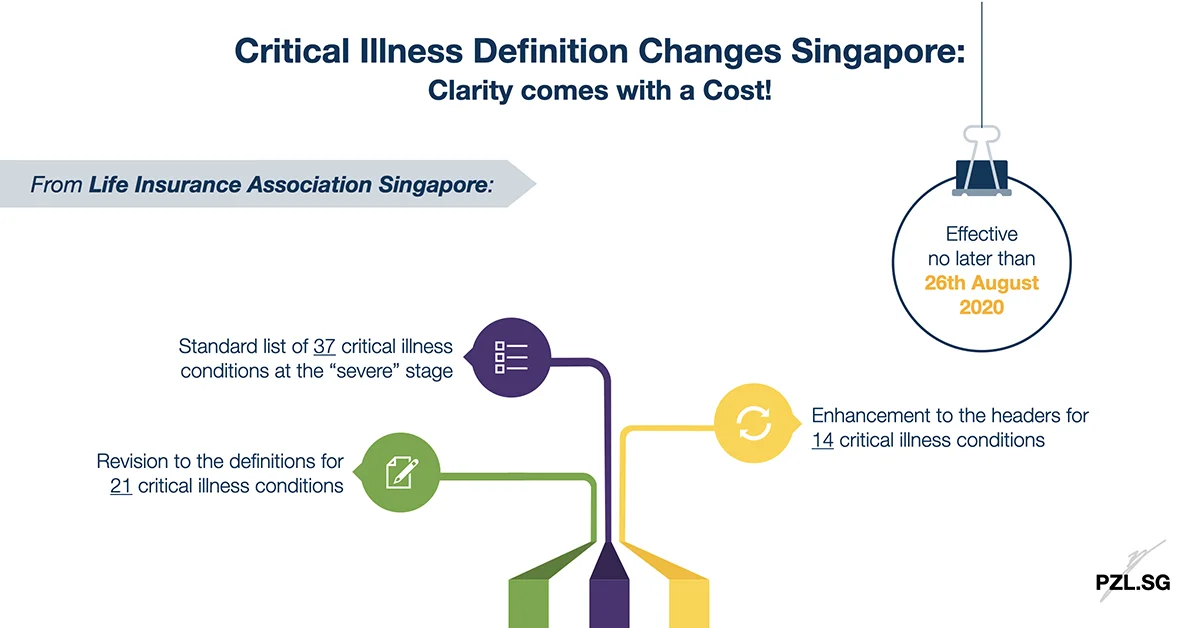

In due time, all the offered critical illness insurance policies will adopt the Version 2019 definitions. Emphatically, they must adopt the updated definitions before 26 August 2020. Overall, these updated definitions provide greater clarity on the situations to admit a claim. Although this may be true, it comes with a cost. Read on to find out how these changes affect us in due time.

Table of Contents:

- Overview on the LIA Critical Illness Framework

- Why is there a change in Critical Illness definition?

- What has changed?

- Which are the affected policies?

- The Timeline for the Change

- Conclusion

Part 1: Overview on the LIA Critical Illness Framework

Summing up, the upcoming changes will affect all the insurance policies that provide critical illness coverage at the “severe” stage. Additionally, this medical condition must be within the LIA Critical Illness framework. (Refer to the blue section in the infographic below.)

Part 2: Why is there a change in Critical Illness definition?

Over the years, medical technology and medical practice have improved. As a result, there exists a need to update the definitions to match the current medical standards. Besides, these changes address the ambiguity that came about during the past five years.

For one thing, this update is a normal practice in the insurance industry. In fact, the industry will review the Critical Illness Framework every three years. This process ensures that the framework remains relevant to the changing times.

Part 3: What has changed?

All in all, there are changes in the definitions for 21 medical conditions on the LIA’s framework. Furthermore, there is an enhancement to the header for 14 medical conditions. This is with the intention to reflect the coverage’s purpose.

Example 3.1: Kidney Failure

For Version 2014, the header is “Kidney Failure” whereas the header for Version 2019 is “End Stage Kidney Failure”.

In short, LIA added “End Stage” to the new definition to reflect its intent. There is no change to the definition to this end.

Example 3.2: Other Serious Coronary Artery Disease

Version 2014: Part of the definition states the following:

The narrowing of the lumen of at least one coronary artery by a minimum of 75% and of two others by a minimum of 60%, as proven by coronary arteriography…

Version 2019: Part of the definition states the following:

The narrowing of the lumen of at least one coronary artery by a minimum of 75% and of two others by a minimum of 60%, as proven by invasive coronary angiography…

Additionally,

Diagnosis by Imaging or non-invasive diagnostic procedures such as CT scan or MRI does not meet the confirmatory status required by the definition.

In this example, Version 2019 added confirmation by invasive coronary angiography. This is because diagnosis via CT scan or MRI alone is no longer acceptable under the revised definition.

Example 3.3: HIV Due to Blood Transfusion and Occupationally Acquired HIV

In this example, the following exclusion has been removed in the new definition (Version 2019),

The insured does not suffer from Thalassaemia Major or Haemophilia.

This is because we have to be fair to this group of people. Consequently, they will be eligible to submit a claim if they acquire HIV through a transfusion.

Part 3.4: Summary of Changes to the LIA Critical Illness framework

In summary,

- There are no changes to the header or the definition for 10 medical conditions;

- The headers (or names) of 14 medical conditions have been enhanced to reflect the intent of coverage;

- There is a revision to the definitions for 21 medical conditions. As a result, there is clearer intent on its scope of coverage.

For this purpose, I have created a summary table on these changes. Above all, I’m not a medical expert. Therefore, I have made these assessments based on my personal understanding for each medical condition. With this in mind, you are advised to seek professional advice to that end.

Part 4: Which are the affected Policies?

In essence, these changes apply to any new applications on or after the dateline. For example,

- New individual policies or benefits;

- New group policies or benefits, including renewals;

- Standalone critical illness policy;

- Critical illness rider to an individual or group policy.

On the other hand, the insurers have the discretion to apply either the Version 2014 definitions or Version 2019 definitions for a small group of policies. For example,

- A yearly renewable term insurance policy with an existing critical illness benefit;

- A health policy (auto-renew) and has an existing critical illness benefit;

- Top-ups to an existing critical illness policy.

In either case, the insurer will inform you on its practice in due time.

Part 5: The Timeline for the Change

For an Individual Policy

At this time, the insurers are are allowed to offer policies that adopts the Version 2014 definitions. In sum, this is available till 25 August 2020 (or earlier). Correspondingly, the policy must be issued by 25 November 2020.

For Group Policy

New applications or renewals that occurs on or after 26 August 2020 will adopt the Version 2019 definitions.

Note: In either case, the insurer may set an earlier cutoff date or impose additional requirements. With this in mind, you are advised to check with the insurer directly for the most accurate information.

Part 6: Conclusion

To conclude, Life Insurance Association Singapore mandates the respective insurers to follow its framework for the listed 37 medical conditions. Emphatically, the insurer must follow the framework if it wants to cover that particular condition.

Without a doubt, this update emphasises the original intent of coverage for the listed 37 Critical Illnesses. However, some common medical conditions have added or clearer exclusions now. By comparison, there is also a medical condition with a more relaxed definition.

In any case, it is definitely a good time to conduct a proper insurance portfolio review now. This is for the purpose of keeping your policies in check. All things considered, change is inevitable. Therefore, you should get covered when you need it, rather than because the terms are changing.

Thoughts of the Day:

- In your opinion, are the new definitions better or stricter?

- Are you currently underinsured?

- When was the last time you have completed a comprehensive insurance portfolio review?

Leave a Reply