As I have noted previously, a lasting power of attorney (or an LPA) is a legal document to allow you (the “donor”) to voluntarily appoint one or more persons (the “donee(s)”) to act on your behalf if you lose mental capacity one day. Evidently, this process is much more efficient as compared to the deputyship process. With this in mind, let’s learn how to make a lasting power of attorney today.

Table of Contents:

- Identify Your Needs

- Determine Your Donee(s)

- Which LPA Form to use

- Lasting Power of Attorney Fees

- Visit an LPA Certificate Issuer (“CI”)

- Submission and Timeline

- Final Thoughts

One Minute Summary:

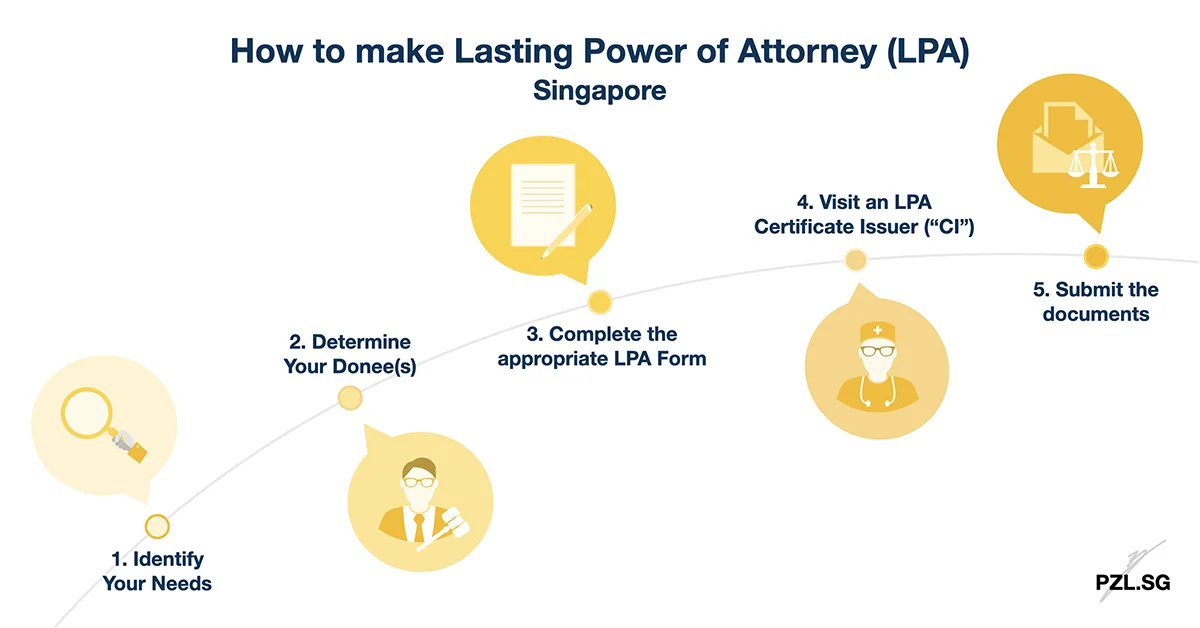

- Altogether, there are five steps to make a lasting power of attorney, or an LPA.

- Firstly, we need to identify your needs and the types of power to grant to your donees.

- Secondly, we need to select the donees who will make the decisions on your behalf if you lose mental capacity one day.

- Based on your needs, we will print and complete either LPA Form 1, or LPA Form 2.

- Thereafter, we need to visit an LPA Certificate Issuer to certify that you are making an LPA on your own accord.

- Finally, in order for the LPA to be valid, you need to register the LPA with the Office of the Public Guardian.

Part 1: Identify Your Needs

To begin with, let’s identify your needs together. In general, you may use an LPA to authorise your donee to act in either or both of the following broad areas:

- Personal Welfare, i.e. relates to your daily activities such as where you should live;

- Property and Affairs, i.e. relates to your financial matters such as how to manage your property.

It is important to realise that if you have appointed your donee to make decisions for personal welfare only, then he cannot make any decisions for property and affairs. In like manner, if you have appointed your donee to make decisions for property and affairs only, then he cannot make any decisions for your personal welfare. This is unless you have granted explicit powers for both personal welfare, as well as for property and affairs.

Additionally, you may also grant specific and customised powers to your donee. To demonstrate, you may wish to restrict your donee from executing certain transactions for Property and Affairs, e.g. to sell a particular property. Through identifying your needs and the powers to be given, we will be able to establish which LPA Form to use later.

Part 2: Determine Your Donee(s)

Secondly, we will select your donee. To explain, a donee is a person who you appoint to act as and to make decisions on your behalf if you lose mental capacity one day. Given that power, you may wish to give a serious thought on who you trust to act in your best interest.

Part 2.1: Possible Questions to consider

To list, you may take the following questions into consideration:

- How well do you know this person on a personal level?

- Is this person of a sound character, and is responsible in nature?

- Do you believe that the person will be able to make decisions that are in your best interest?

- Does the person know your healthcare and financial preference?

- How well does the person manage his or her own private affairs?

Above all, your donee(s) must exercise their powers in accordance with the Mental Capacity Act Code of Practice.

Part 2.2: Legal Criteria

Meanwhile, the donee needs to be at least 21 years old, and

- For personal welfare, the donee must be an individual.

- For property and affairs, the donee cannot be someone who is legally bankrupt.

Furthermore, you may also appoint a licensed trust company as the donee for property and affairs.

Generally, there is no restriction on the maximum number of donees that you can appoint for your LPA. Although this may be true, it does not mean that you should appoint as many persons as possible. After all, they will be the ones to make decisions on your behalf in the future. If you appoint too many donees, then it may pose as a challenge for all of them to reach a consensus for the decisions that need to be made.

Part 2.3: How will the decisions be made?

If you wish to appoint more than one donee, then you need to determine how they will make decisions on your behalf; that is

- Jointly: On this occasion, all your donees have to agree on the decision and to act together. To put it another way, neither of the donees may act on his or her own. For the same reason, this joint appointment will be terminated when any of the donees is no longer able to act.

- Jointly and severally: In this situation, your donees may make decisions together or separately. To this end, both types of decisions are valid.

For one thing, you may choose to allow your donees to make some decisions ‘jointly’, and other decisions ‘jointly and severally’.

Part 2.4: Replacement Donee(s)

In truth, your donee may not be able to act on your behalf forever. To illustrate, your donee

- Gives notice to the Office of the Public Guardian (OPG) that he disclaims his appointment when he does not wish to be a donee anymore;

- Passes on;

- Becomes bankrupt (this will only terminate his power in relation to your Property and Affairs);

- And your divorce, or have your marriage annulled; or

- Loses mental capacity.

Under those circumstances, your LPA may be revoked. In order to overcome this, you may wish to appoint a replacement donee and to indicate the situation when the replacement donee shall replace an existing donee, e.g.

- Any donee who is unable to act;

- Any donee with Personal Welfare powers who needs replacing;

- Any donee with Property and Affairs powers who needs replacing;

- Donee 1 only;

- Donee 2 only.

On the whole, it is optional to appoint a replacement donee. Hence, you may skip this section if you do not wish to appoint a replacement donee for your LPA.

Part 2.5: Required Information

After you have selected your donee(s), we will need to obtain the following information from him (or her):

- Full Name as in NRIC / FIN / Passport;

- NRIC / FIN / Passport;

- Date of Birth;

- Email Address;

- Contact Number;

- Relationship to Donor;

- Local Mailing Address.

In like manner, you (as the donor) may decide on the powers to grant to the donee (as mentioned in Part 1).

Part 3: Which LPA Form to use

Now that we have identified your needs, and your donee(s), we may complete either LPA Form 1, or LPA Form 2.

Part 3.1 LPA Form 1

As a matter of fact, 98% of the Singapore Citizens who have made an LPA used Form 1. In detail, LPA Form 1 allows you to grant one or two donees general powers with basic restrictions. As I have noted earlier, such power may be for your personal welfare, and/or property and affairs. For this purpose, you may

- Download the LPA Form 1, print it, and complete the form manually; or

- Use My Legacy’s LPA-ACP tool as a guide to help you to complete the form online before printing it.

Part 3.2: LPA Form 2

If you face any limitations from an LPA Form 1, then you may use an LPA Form 2 instead. For example, you may want to

- Appoint more than two donees;

- Appoint more than one replacement donees.

- Grant specific and customised powers to donees which cannot be addressed in an LPA Form 1.

To that end, you will need to engage a lawyer to draft the LPA Form 2.

Part 4: Lasting Power of Attorney Fees

Part 4.1: LPA Form 1 Fee

Depending on your residency status, the following fee may apply for an LPA Form 1:

- Singapore Citizen: $0 (The fee of $75 is waived until 31 March 2023)

- Singapore Permanent Resident: $100

- Foreigner: $250

Part 4.2: LPA Form 2 Fee

By comparison, the following fee shall apply for an LPA Form 2:

- Singapore Citizen: $200

- Singapore Permanent Resident: $250

- Foreigner: $300

Part 5: Visit an LPA Certificate Issuer (“CI”)

After you have printed and completed the appropriate LPA Form, you need to visit an LPA Certificate Issuer (“CI”). By and large, the Certificate Issuer’s role is to check and confirm that you have understood the purpose of an LPA, and has not been forced or deceived into making an LPA. In addition, the Certificate Issuer will also clarify your intention to appoint the stipulated persons as your donees, and the powers to be granted.

In general, there is no requirement for the donee to be present when the Certificate Issuer witnesses and certifies your LPA. While this may be true, some Certificate Issuers may prefer for your donee to be present. With this intention in mind, you should check the exact requirement with the Certificate Issuer directly.

Part 5.1: Who can be an LPA Certificate Issuer

Summing up, there are three groups of professionals who can issue an LPA certificate; that is

- A medical practitioner who is accredited by the Public Guardian to issue LPA certificates;

- A medical practitioner who is registered as a specialist in psychiatry under the Medical Registration Act; or

- An advocate and solicitor of the Supreme Court who has in force a valid practising certificate under the Legal Profession Act.

Part 5.2: Who cannot be an LPA Certificate Issuer

On the other hand, the following parties cannot be the Certificate Issuer for your LPA:

- Yourself (as the donor);

- Your donee;

- Your replacement donee;

- Any person who is related to, or an employee, or a business partner of any of the above mentioned parties.

All things considered, the Certificate Issuer must not act under a conflict of interest.

Part 5.3: Top 10 most Frequently visited Certificate Issuers

At this time, the Ministry of Social and Family Development has compiled the top ten most frequently visited Certificate Issuers in each group. Given that the Office of the Public Guardian does not prescribe the fees charged, you should check the fees involved with the Certificate Issuer directly. On balance, the majority of the top ten most visited accredited medical practitioners charged $50 or less.

Part 6: Submission and Timeline

In order for your LPA to be valid, you need to register it with the Office of the Public Guardian. Accordingly, you will need to mail the completed LPA Form, a photocopy of your donee(s)’ and your NRIC to

Office of the Public Guardian

Ministry of Social and Family Development

20 Lengkok Bahru

#04-02, Family@Enabling Village

Singapore 159053

Once the Office of the Public Guardian has received your application, you will receive an acknowledgement letter within two weeks. Thereafter, there will be a mandatory waiting period of three weeks. During this period, your donee(s) may raise an objection. If there are no objections raised during this period, then the LPA will be registered on the next working day following the expiry of the mandatory waiting period. Finally, both your donee(s) and you will receive a Notice of Registration letter within a week from the LPA’s registration.

Part 7: Final Thoughts

As can be seen, making a lasting power of attorney is a thoughtful process that focuses on trust. This is because you will be granting powers to a person (and/or a licensed trust company) to make most of the decisions on your behalf. In effect, such decisions could affect the way you live, as well as the possessions you own.

Despite that, you shouldn’t be afraid or to become overly worried about making a lasting power of attorney. After all, an LPA offers you the opportunity to choose someone who you trust to act on your behalf. This is as compared to the deputyship process where you would have no control over who to make such decisions on your behalf. Consequently, I’m of the view that you should make an LPA while you can, and when you can do so.

Lastly, a lasting power of attorney is not a permanent arrangement. As long as you have the mental capacity, you may always revoke the existing lasting power of attorney and to draft a new one. Therefore, you do not need to overthink this process.

Leave a Reply