As one of the easiest to read books on personal finance in Singapore, Money Wisdom aims to share simple truths for financial wellness. in detail, author and veteran financial advisor Christopher Tan shares insights on how you should approach your planning towards and to lead a meaningful life. Although I rate Money Wisdom as an easy-to-read book, not everyone has the luxury of time to read the entire book. With this in mind, here is a chapter-by-chapter summary that you may find useful.

Table of Contents:

- Chapter 1: Are You Financially Fit?

- Chapter 2: Insurance Planning: The Basic Principle

- Chapter 3: The Case for Term Insurance

- Chapter 4: Confessions of a Financial Adviser

- Chapter 5: Realisations of a Financial Adviser

Chapter 1: Are You Financially Fit?

Part 1.1: Chapter Summary

In summary, Chapter 1 lists six financial markers to keep your finances in check. Thereafter, it suggests five ways to ensure that you stay in the healthy zone with these six markers.

Part 1.2: Six Financial Health Markers

- Firstly, Rainy Day Marker measures the amount of emergency fund that you have in your savings. In detail, this money is used to fund an emergency, e.g. job loss. Generally, you should set aside at least six months of monthly expenses in savings. Notwithstanding that, you should adjust this ratio according to your age, area of specialisation, and ease of re-employment.

- Secondly, Risk Readiness Marker refers to your financial preparedness to deal with possible risks in life, e.g. job loss, death, and major illness. For this purpose, a hospitalisation insurance reduces the out-of-pocket expenses for your medical bill. Next, you should have sufficient Death, and Disability coverage to pay for your family’s expenses until the youngest child becomes independent. Finally, you should have about three years of gross income for Critical Illness coverage.

- Thirdly, Debt Marker determines whether you are into too much debt. Generally, you should keep this weightage to below 35% of your total gross income. Furthermore, if you are a contract staff, or works on a flexible wage scheme, then you should reduce the marker to below 25% of your total average monthly income.

- Fourthly, Piggy Bank Marker suggests you to save at least 10-15% of your total income. In sum, this includes monies in life insurance policies, and investments in unit trusts.

- Next, Water Marker measures the liquidity of your net worth – divide liquid assets by net worth (assets minus liabilities). To illustrate, liquid assets can be cash and bank accounts, investments in bonds and shares. In general, you should have at least 15% of your net worth in liquid assets. This is so as to be able to cash out your assets for an emergency.

- Finally, Personal Development Marker suggests you to make yourself more employable through training in knowledge and skills. Moreover, expand your social circle and build a network of solid friendships.

Part 1.3: Nurse Yourself Back to Health

In the event that you are falling behind the benchmark, Christopher suggests five ways to nurse you back to health.

- Seek help: Ask a financial advisor to coach you.

- Look at ways to cut expenses: Re-finance housing loans, downsize your car, restructure current insurance portfolio.

- Set up a rainy day fund: Use an automated budget scheme to help you.

- Pay off debts: Restructure your debt repayment scheme and create a process to clear your liabilities. In addition, you may use a lower interest facility to pay off debts with a higher interest.

- Pay yourself first: Start planning for long-term financial objectives, e.g. retirement. Thereafter, create a plan to invest towards these objectives every time you get your income, and before your expenses.

Chapter 2: Insurance Planning: The Basic Principle

Part 2.1: Chapter Summary

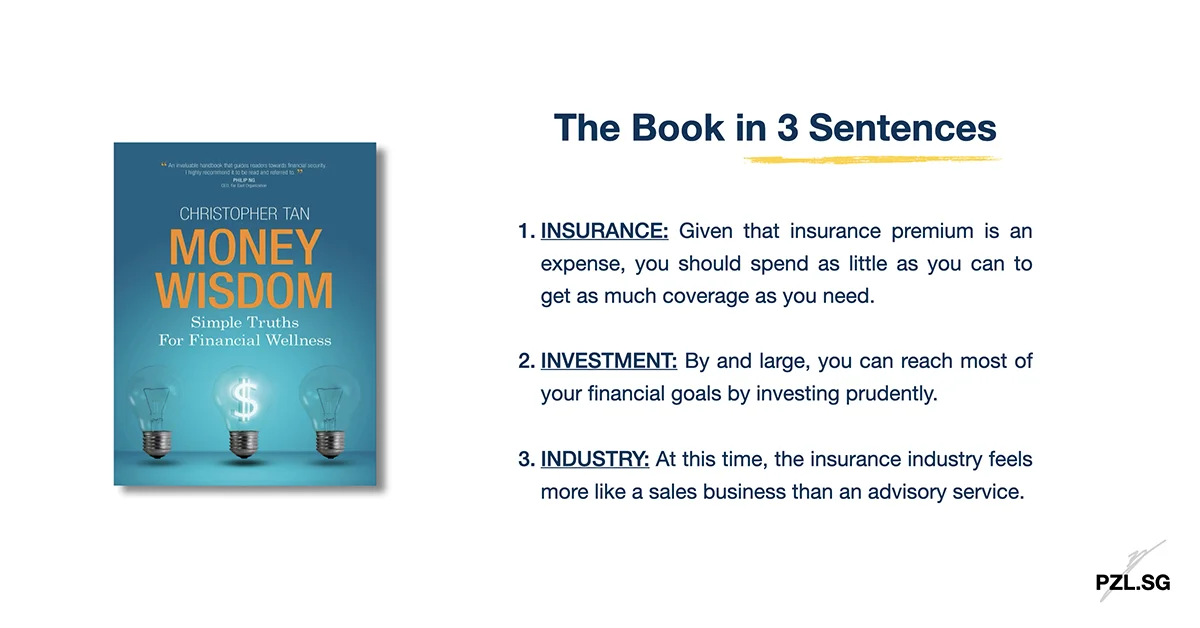

Summing up, Chapter 2 states that insurance premium is an expense. Consequently, you should spend as little as you can, and get as much coverage as you need. Next, Christopher feels that you will need medical insurance for as long as you live. However, unlike medical insurance, the dependency to use life insurance to protect your life is a temporary need only. In other words, you will no longer need life insurance one day. For this purpose, you should use insurance for life protection only. This is because there are better financial instruments to save and invest your money. Therefore, do not mix insurance protection with wealth accumulation!

If you intend to apply for insurance coverage, then you are required to make a full disclosure of your medical history at the time of application. To explain, the underwriting assessment is based on the declared information in the application. Thereupon, the insurer may offer you a standard cover, or a cover with exclusions for pre-existing medical conditions, or to not insure you at all.

All things considered, the best plan available on the market may not be the most suitable plan for you. To illustrate, if you are living in Singapore all the time, then a local coverage plan will probably be more than sufficient for you. Thereafter when you travel, get a travel insurance policy to cover the additional risk involved.

Part 2.2: Three Types of Healthcare Insurance Coverage

- Local Coverage: In this situation, the coverage is for use in Singapore only. For this purpose, you can have the option to stay in a one-bedroom ward in a public or private hospital. While the coverage is limited (as compared to the rest of the options), the cost is affordable. Furthermore, you may use CPF MediSave to pay for a part of the insurance premium.

- Regional Coverage: In this case, the plan covers for medical expenses mainly in ASEAN countries. It is important to realise that such plans do not cover you for life. For example, the insurance policy may cover you till 75 years old, or when you exhaust its lifetime claim limit.

- Global Coverage: For the most part, this is a very comprehensive healthcare insurance policy that covers both outpatient and inpatient treatments. Although this sounds like an amazing deal, you must be prepared to pay a higher cost as well.

Part 2.3: Author’s Belief

Above all, Christopher feels that insurance should be strictly used for life protection only. Hence, you should not use insurance for savings, and/or investment.

Part 2.4: Meaningful Quotes

- Money is a resource. With it, you can make many things happen in life, not just for yourself, but for others as well.

- With every dollar wasted, it is an opportunity foregone to help someone really in need.

- With good planning, you can have enough for yourselves and still bless many others around you.

Chapter 3: The Case for Term Insurance

Part 3.1: Chapter Summary

By and large, Chapter 3 highlights why you should use a term insurance policy for your insurance needs, and why Insurance Agents do not promote it as much.

Part 3.2: Why You should consider a Term Insurance Policy

Generally, insurance is used as an income replacement tool against death, disability, or critical illness. However, when you retire, you will stop earning an active income and will rely on your savings instead. Since there is no income to replace in this case, you don’t need to depend on insurance anymore.

Part 3.3: Term vs Whole Life Insurance

For the most part, here is one of the most common argument against using a term insurance policy to meet your protection needs. In detail, when the term insurance policy expires, you won’t get anything back. In truth, you won’t get back the mortality charges from a whole life insurance policy too!

Of course, one may argue that you do get some money back from a whole life insurance policy in the later years. To explain, this is because you have given the insurer more money to invest into its participating fund. Therefore, it is only reasonable to receive some of the accumulated cash value in due time. In any case, it is important to realise that the returns from a whole life insurance is probably mediocre and insufficient to help you reach your financial goals.

Overall, a whole life insurance policy is expensive and thus unlikely to provide you with an adequate level of protection. On the contrary, a term insurance policy is much more affordable and thus more capable of fulfilling your protection needs. Thereafter, you may use the savings (from the cheaper premium) to invest and to work towards your financial goals.

In general, salespeople will find whole life insurance more appealing as the commission is usually higher (with its higher premium).

Chapter 4: Confessions of a Financial Adviser

Part 4.1: Chapter Summary

On the whole, Chapter 4 points out the common misconceptions about whole life insurance policies. Thereafter, Christopher went on to dispel these misconceptions. Additionally, Chapter 4 also illustrates how you can achieve the same outcome (as whole life insurance) by using a different set of financial instrument; that is, a term insurance policy and to invest the remaining budget. To point out, the latter methodology tends to give you better control and flexibility.

To explain, in a whole life insurance policy, part of your monies is invested into the insurer’s participating fund. In general, the participating fund comprises of a mixture of bonds and equities. To that end, the participating fund will face investment risks that are similar to investing your money on your own.

Overall, a term insurance policy is able to give you higher control over your money. This is because of the lower rate of insurance premium. For that reason, you will be able to purchase a term insurance policy that is capable of insuring you completely. In like manner, you will have the flexibility to use the remaining budget to invest into instruments that fit into your risk profile. For this purpose, you can choose investment vehicles that allow you to withdraw your money at any time without incurring any penalty charges.

Part 4.2: Proponents of a Whole Life Insurance Policy

- Firstly, whole life insurance is both a systematic and organised way for you to save money. At the same time, whole life insurance is able to give you better returns than bank deposits. Furthermore, you get to enjoy insurance coverage as well.

- Given that whole life insurance accumulates a cash value, this insurance policy will not lapse when you are unable to pay the premium due to unforeseen circumstances.

- Thirdly, in the case of a term insurance policy, if you don’t make a claim, then you won’t get a single cent back.

- Fourthly, a term insurance policy is unable to cover you for life. To add on, you don’t know when you will need the insurance coverage.

- Next, a term insurance policy does not have any cash value. As a result, it doesn’t hedge against inflation.

- Finally, if you are not investment-savvy, then “buy term and invest the rest” will not work for you. To that end, buying a whole life insurance policy is a safer choice.

Part 4.3: Counter-Arguments against Whole Life Insurance Policy

- Firstly, bank deposits are known to be short-term financial instruments that provide both liquidity and flexibility. In contrast, insurance is considered to be a long-term instrument that is neither liquid nor flexible. Consequently, it is unfair to compare whole life insurance with bank deposits.

- In the event that you use the cash value in the whole life insurance to pay for the insurance premium, you are effectively taking on an insurance policy loan. To this end, you will pay interest at a rate of about 6% per annum for this insurance policy loan.

- In the case when you cannot afford to save as much, whole life insurance doesn’t allow you to reduce your savings. This is because the insurance premium is fixed at the beginning.

- It is important to realise that the mortality charges in a whole life insurance policy is not invested as well. As a result, there is no much difference in the charges between term insurance or whole life insurance.

- Generally, you do not need to insure yourself for life. Instead, you will rely on your retirement fund after you retire. Hence, there is no need for insurance coverage after this period.

- Given that lower rate of insurance premium, term insurance is more capable of insuring you for your entire insurance needs.

- Next, let’s assume that you “buy term and invest the rest”. In the event of a financial difficulty, you are able to stop the investment portion without jeopardising your term insurance coverage. What’s more, you are also able to dip into your investment portfolio to pay for the insurance premium – without needing to pay any interest.

- Finally, when you choose to invest on your own, you will have more choices for investment. Under those circumstances, it is more likely that you will invest into a portfolio that suits your risk profile. Moreover, you are also able to adjust the portfolio according to your risk appetite then.

Chapter 5: Realisations of a Financial Adviser

Enjoying the book summary? Subscribe to my newsletter to be notified when I publish the book summary for this chapter!

Leave a Reply