The Singlife Account is an insurance savings plan that enables you to earn a non-guaranteed crediting rate for your money. Although it is neither a bank account nor a fixed deposit, its no-nonsense approach allows you to earn an interest of at least 1.5% per annum without jumping through any hoops. With this in mind, let’s learn whether the Singlife Account is better than your conventional bank account.

Table of Content:

- What is Singlife Account

- Insurance Coverage (Benefits)

- Cash Value

- Cost

- Limitations and Risks

- Insurance Nomination

- Bonus Return Campaign

- Eligibility

- How to Start

One Minute Summary:

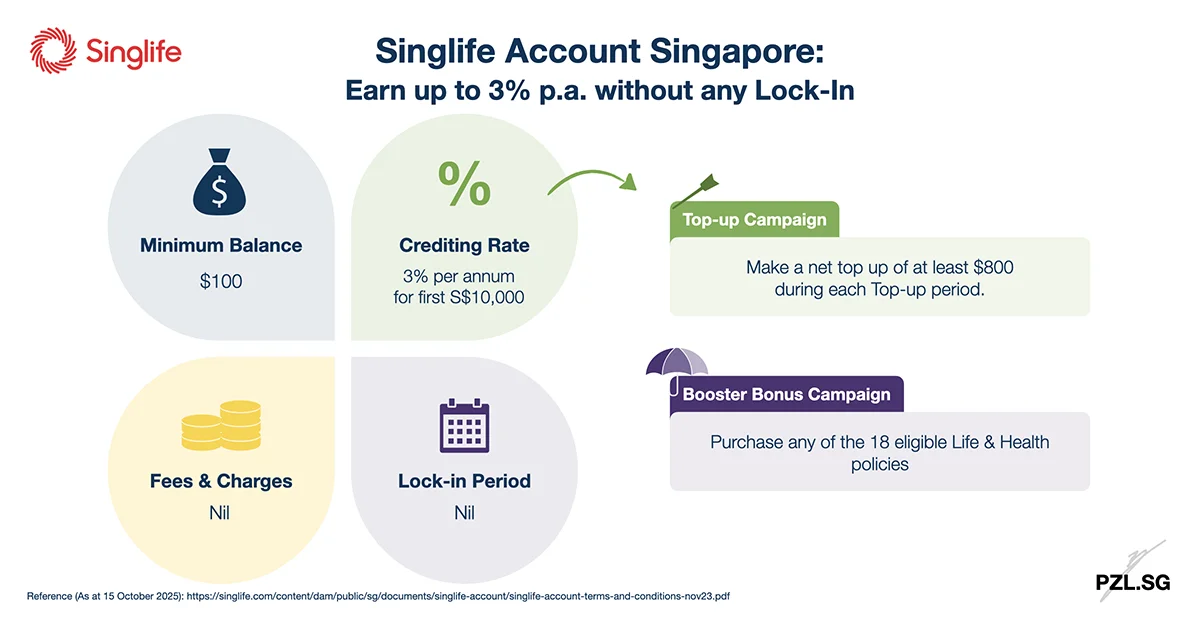

- The Singlife Account is a non-participating universal life insurance policy.

- In order to earn an interest, you will need to deposit at least $100 and to maintain at least $100 in your Singlife Account.

- At this time, you can earn a non-guaranteed crediting rate of up to 3% per annum for your deposit on your Singlife Account.

- Summing up, Singlife will credit the interest earned into your Singlife Account on the first day of the following policy month.

- Given that there is no lock-in period, you may deposit and withdraw your money at any time via FAST.

Part 1: What is Singlife Account

In essence, the Singlife Account is a non-participating universal life insurance policy that focuses on your wealth accumulation need. Additionally, it also provides you with basic life insurance coverage in the event of death, or terminal illness.

Part 2: Insurance Coverage (Benefits)

As the policy owner and the life assured, Singlife Account provides you with two types of insurance coverage.

Part 2.1: Death Benefit

In sum, your estate will receive your account value plus

- The lower of 5% of account value, or $50,000 (if death occurs before your 61st birthday); or

- The lower of 1% of account value, or $50,000 (if death occurs on or after your 61st birthday).

To point out, in order for $50,000 to the lower amount, you will need to deposit between $1mil to $5mil with Singlife. Despite that, I must warn you against doing so. In fact, you should not deposit more than $100,000 into your Singlife Account – read Part 3.2 on Interest Earned to find out why.

Part 2.2: Terminal Illness Benefit

If you are diagnosed with a terminal illness, then Singlife will pay the full death benefit as the terminal illness benefit. Thereafter, Singlife will terminate your insurance savings policy.

Part 3: Cash Value

Above all, the Singlife Account is a capital-guaranteed insurance savings plan. As a result, you can rest assured that you will most certainly get your capital back when you surrender your Singlife Account policy.

Part 3.1: Account Value

After you deposit at least $100 into your Singlife Account, the insurance savings plan will become in-force. At this point, your account value will be equal to the amount that you have transferred into your Singlife Account. To illustrate, if you have transferred $500 into your Singlife Account, then your account value will be $500. Thereafter, your account value will be equal to:

- The account value, including interest credited (as of the beginning of the policy month); plus

- All ad-hoc top-ups that you have made during the policy month; less

- Any withdrawals that you have made during the policy month.

Part 3.2: Interest Earned

In order to earn an interest, your account must have at least $100. Thereupon, Singlife will calculate the interest earned based on your daily account value. For this purpose, there are two types of crediting rate that you should know – the minimum guaranteed crediting rate as stated in your Policy Schedule, and the non-guaranteed crediting rate that Singlife declares from time to time.

At the present time, the minimum guaranteed crediting rate is 0.00% per annum, i.e. no gain, no loss. Meanwhile, for the non-guaranteed crediting rate, you will earn 1.5% per annum on your first $10,000. Thereafter, from $10,000.01 to $100,000, you will earn a base return of 1% per annum. It is important to realise that you will not earn any interest for the amount that is above $100,000. Hence, I will discourage you from putting too much money into your Singlife Account. Summing up, Singlife will credit the interest into your account on the first day of the following policy month.

Part 3.3: Changes in the Crediting Rate

Since its launch in the year 2019, Singlife has adjusted its non-guaranteed crediting rate ten times.

- At launch: Up to 2.5% per annum; Up to 1.00% per annum for the next $90,000.

- From 1 November 2020: Up to 2.0% per annum; Up to 1.00% per annum for the next $90,000.

- From 29 January 2021: Up to 1.5% per annum; Up to 1.00% per annum for the next $90,000.

- From 1 July 2021: Up to 1.00% per annum for the first $10,000; Up to 0.50% per annum for the next $90,000.

- From 1 October 2022: Up to 2.5% per annum for the first $10,000; Base return of 1.1% per annum for the next $90,000.

- From 22 February 2024: Up to 4% per annum for the first $10,000; Base return of 1% per annum for the next $90,000.

- From 17 June 2024: Up to 3.5% per annum for the first $10,000; Base return of 1% per annum for the next $90,000.

- From 2 September 2024: Up to 4.5% per annum for the first $10,000; Base return of 1% per annum for the next $90,000.

- From 1 July 2025: Up to 3.5% per annum for the first $10,000 (Base return of 2% per annum); Base return of 1% per annum for the next $90,000.

- From 15 October 2025: Up to 3% per annum for the first $10,000 (Base return of 1.5% per annum); Base return of 1% per annum for the next $90,000.

If you wish to be notified whenever Singlife makes an adjustment to the Singlife Account’s crediting rate, then enter your name and email address below to join my free newsletter.

Part 3.4: Withdrawal of Funds

Unlike some other insurance products on the market, there is no lock-in period for this insurance savings plan. As a result, you may use the Singlife app to withdraw the money to your designated bank account via FAST at any time. In general, it may take up to three hours for the withdrawn fund to show up in your bank account. Although the withdrawal should work as expected in most instances, I had a scare episode in 2021. At that time, the money that I have withdrawn went “missing” for a few days; you may read about my encounter in my newsletter – a separate column where I share exclusive insights to my newsletter subscribers.

Meanwhile, you may wish to note that you may withdraw up to a maximum of $20,000 daily.

Part 4: Cost

Part 4.1: Fees and Charges

On the whole, Singlife does not charge any fees for this insurance savings policy.

Part 4.2: Distribution Cost

In general, distribution cost includes commissions and other benefits paid to financial advisers. Since this insurance policy is sold without any financial advice, there is no distribution cost for this product.

Part 5: Limitations and Risks

Before you open a Singlife Account, here are some limitations and risks that you should be aware of.

Part 5.1: Minimum Balance

To start earning interest, you need to maintain a minimum account value of $100 in your Singlife Account. If your daily account value falls below $100 for a continuous 60 days, then you will need to top up the difference within a 60 days’ grace period. Otherwise, Singlife reserves the right to terminate your policy.

Part 5.2: Renewability

As a yearly renewable universal life insurance policy, Singlife will renew the insurance policy automatically every year (on the policy anniversary date). Summing up, Singlife may renew the policy up to the policy anniversary following your 100th birthday. Notwithstanding that, Singlife Account’s coverage is not guaranteed for whole of life. In fact, there is a clause in the insurance policy contract that states that Singlife reserves the right to terminate your policy on any policy anniversary by giving you ninety (90) days’ notice. Similarly, Singlife is also able to change your insurance policy’s terms and conditions by giving you the same notice.

Part 5.3: Change in Crediting Rates

Although Singlife mentioned that all the crediting rates are not guaranteed, its website did not state whether Singlife will give any notice period before making such an adjustment. That being said, I managed to clarify this lack of information in the policy contract. In detail, the policy contract states that Singlife may revise the crediting rate at any time and any revision will take effect immediately.

Part 5.4: Free-look Period

To sum up, you have fourteen (14) days to evaluate if the Singlife Account meets your needs and expectations. If not, during this free-look period, you can terminate the insurance savings policy and Singlife will refund the premiums that you have paid, without interest, less any withdrawal amounts or any expenses incurred in processing your application.

Part 5.5: Exclusion

Singlife will not pay any claim arising directly or indirectly from the following three events:

- For the death benefit, if you attempted suicide or suicide within one year from the policy’s commencement date.

- For terminal illness benefit, if you attempted suicide within one year from the policy’s commencement date; or you are infected by Human Immunodeficiency Virus (HIV).

Under those circumstances, Singlife will refund your account value only.

Part 5.6: Policy Owners’ Protection Scheme

Above all, Monetary Authority of Singapore regulates the Singlife Account. Accordingly, the Policy Owners’ Protection Scheme applies to your Singlife Account. In brief, this means there is 100% protection for the guaranteed benefits in your Singlife Account, up to $100,000 for the aggregated guaranteed surrender value.

Part 6: Insurance Nomination

Given that this is a universal life insurance policy, you may name your intended beneficiaries by submitting either a revocable nomination or a trust nomination. Otherwise, the death benefit will be distributed according to the Intestate Succession Act.

Part 7: Bonus Return Campaign

Part 7.1: Singlife Account Top-up Campaign (1.5% + 0.5% bonus return)

When you top up at least $800 during each top-up period, you will earn an additional 0.5% bonus return on the first $10,000 in your Singlife Account. To do so, you may perform either a single lump sum or multiple top-ups during the top-up period. Each top-up period starts from your Singlife Account’s monthly Crediting Date (your policy date) and ends on the day before the next monthly Crediting Date. Singlife will credit the earned bonus return into your Singlife Account on the first day of the following policy month.

Part 7.2: Singlife Account Booster Bonus Campaign

When you purchase any of the 18 eligible Life & Health policies from Singlife, you will earn an additional 1% bonus return on the first $10,000 in your Singlife Account. You will continue to earn this bonus return over the next one year (based on the issuance date of the eligible policy). The list of eligible policies are:

- Singlife Digital Saver

- Singlife Simple Term

- Singlife Elite Term II

- Singlife Whole Life

- Singlife Big 3 Critical Illness

- Singlife Comprehensive Critical Illness

- Singlife Multipay Critical Illness

- Singlife Essential Critical Illness

- Singlife Cancer Cover Plus II

- Singlife Flexi Life Income II

- Singlife Savvy Invest II

- Singlife Flexi Retirement II

- Singlife Legacy Income

- Singlife Steadypay Saver

- Singlife Choice Saver

- Singlife Dementia Cover

- Singlife Disability Income

- Singlife Accident Guard

Part 8: Eligibility

By and large, Singapore residents between the age of 18 and 75 may apply for a Singlife Account. This is so long as you have a valid NRIC or FIN, a valid Singapore-registered mobile number and a Singapore residential address.

Part 9: How to Start

- Download the Singlife app.

- Next, create a Singlife ID.

- Finally, transfer a minimum sum of $100 into your Singlife Account to activate your insurance savings policy.

First Published: 16 September 2020

Last Updated: 15 October 2025

Leave a Reply