But before you commit into your next insurance policy, let’s understand how a critical illness insurance policy work in Singapore.

Table of Contents:

- LIA Critical Illness Framework

- What is Critical Illness Insurance

- Types of Critical Illness Insurance coverage

- Types of Critical Illness Insurance Policy

- Critical Illness Insurance vs Healthcare Insurance

- Final Thoughts

Part 1: LIA Critical Illness Framework

Altogether, the Life Insurance Association Singapore (LIA) has put together a standard list of 37 medical conditions. By and large, the LIA has specifically compiled this list by way of common definitions. To point out, these definitions cover the “severe” stage of the respective medical conditions. On balance, this framework offers a clear and consistent coverage across the insurance industry.

Despite that, there is no minimum number of medical conditions that an insurer must cover. For instance, some insurers only cover 36 medical conditions for the “severe” stage critical illness.

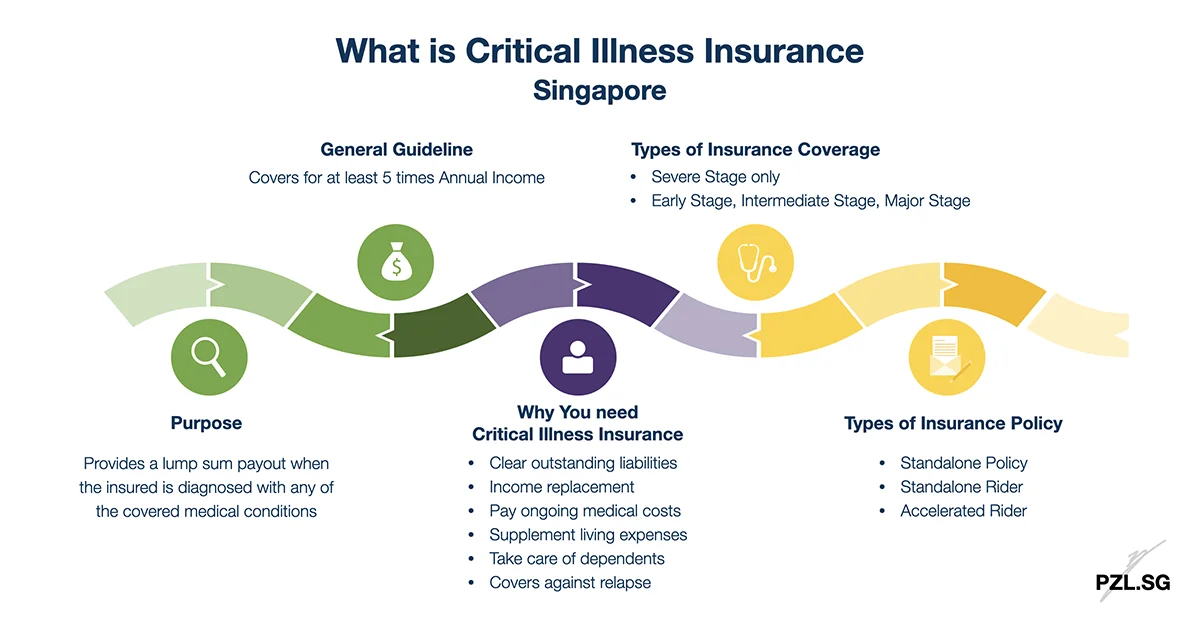

Part 2: What is Critical Illness Insurance

Basically, the insurer pays you a sum of money when the doctor certifies that you have one of the covered critical illness. In sum, this is based on the sum insured in your insurance policy. Before you get the payout, the insurer will deduct any amount owed to them.

Part 2.1: Angioplasty and Other Invasive Treatment for Coronary Artery

Based on the LIA Critical Illness framework, you will receive 10% of the sum insured, capped at S$25,000. Furthermore, the insurer will only pay this benefit once. In effect, the Critical Illness coverage’s sum insured will reduce accordingly.

Firstly, payment under this condition is limited to 10% of the Sum Assured under this policy subject to a S$25,000 maximum sum payable. Next, this benefit is payable once only and shall be deducted from the amount of this Contract, thereby reducing the amount of the Sum Assured which may be payable herein. – LIA Critical Illness Framework 2019

As an illustration, I have a critical illness insurance policy that insures me for $100k. For this purpose, I can claim $10k ($100k x 10%) for Angioplasty. Thereafter, the insurance policy will continue to insure me for $90k ($100k – $10k).

Part 2.2: Survival Period

Before a critical illness claim becomes admissible, you need to survive beyond a stipulated period of time. Generally, the shorter the survival period, the earlier we can admit a claim.

Example: 7 days from the date of diagnosis of the medical condition

Part 2.3: Waiting Period

Above all, there is usually a 90 days waiting period for the below mentioned critical illnesses at the severe stage:

- Angioplasty & Other Invasive Treatment for Coronary Artery;

- Coronary Artery By-pass Surgery;

- Heart Attack of Specified Severity;

- Other Serious Coronary Artery Disease;

- Major Cancer.

For that reason, the insurer will not pay any Critical Illness benefits during this period.

Part 2.4: Non-Guaranteed Premium

It is important to realise that the premium for critical illness coverage is usually non-guaranteed. To put it another way, the insurer may revise the payable premium on an aggregate level.

For instance, the insurer may revise the premium in order to meet its obligations. Undeniably, this could also be due to any future amendments to the laws and regulations of Singapore.

Part 2.5: Free-Look Period

Similar to most insurance policies, you get a 14-day free-look period for a critical illness insurance policy. This is for the purpose of allowing you to review the policy documents carefully.

If you cancel the policy during this period, then the insurer will refund the premium back to you. Under those circumstances, the insurer may deduct any medical fees that were incurred during the application.

For hardcopy contract:

In this case, the free-look period starts seven days from the date the insurer posts the policy contract to you.

For electronic contract:

In this situation, the free-look period starts when you receive a notification that the policy contract is available for viewing.

As part of my professional practice, I like to schedule a meeting with my client during the free-look period. For one thing, we will go through the policy wordings together. This is with the intention to ensure that everything that I have explained at the point of application can be found within the policy contract. In case of any discrepancy or violent objection, the client can cancel the policy at no additional cost.

Part 3: Types of Critical Illness Insurance coverage

Summing up, there are three types of critical illness insurance coverage.

Part 3.1: Single Claim, covers Severe Stage only

In this case, you will receive a payout when you have a critical illness at the severe stage. After the payout, the insurer will terminate this benefit.

Undoubtedly, there is no payout when your critical illness is at the Early Stage, or Intermediate Stage.

Part 3.2: Single Claim, covers Early Stage, Intermediate Stage, and Severe Stage

In this situation, you will receive a payout when you have a critical illness at any of the covered stage. Thereafter, the insurer will terminate this benefit.

What happens when more than one medical condition is diagnosed on the same date?

On this occasion, the insurer will admit one claim for the medical condition diagnosed as the more or most severe stage.

Part 3.3: Multi Claim, covers Early Stage, Intermediate Stage, and Severe Stage

Similarly, you will receive a payout when you have a critical illness at any of the covered stage.

After a stipulated period of time, the policy will restore the critical illness coverage, e.g. to 100%. In time to come, you will be able to submit another claim.

Part 4: Types of Critical Illness Insurance Policy

Overall, there are three common ways to get critical illness insurance coverage in Singapore.

Part 4.1: Standalone Policy

Firstly, you may get a standalone critical illness insurance policy. To be sure, this is usually a term insurance policy. At length, its main purpose is to provide critical illness coverage.

What happens after a Critical Illness claim is made (Single Claim benefit)?

After the insurer pays the full sum insured, the policy will terminate.

What happens after a Critical Illness claim is made (Multi Claim benefit)?

As I have noted in Part 3.3, the insurance policy will restore the critical illness coverage after a stipulated period of time. Thereafter, the insurance policy will continue to provide critical illness coverage. This works in similar fashion for the Standalone Rider (Part 4.2), and the Accelerated Rider (Part 4.3).

Part 4.2: Standalone Rider

Secondly, you may attach a critical illness rider to a basic insurance policy. For the most part, we may add the coverage onto a term insurance policy, or a whole life insurance policy.

What happens after a Critical Illness claim (Single Claim benefit)?

In this case, the critical illness rider will issue the payout. Thereafter, the insurer will terminate the rider. Despite that, this critical illness claim does not affect the basic insurance policy. Therefore, you can still enjoy the full benefits under the basic insurance policy.

To demonstrate, let’s assume the following policy benefits for your insurance policy:

- Death Benefit: $500k

- Critical Illness Benefit: $250k

Accordingly, we may claim $250k for critical illness. Be that as it may, the death benefit remains the same, i.e. $500k.

Part 4.3: Accelerated Rider

Similar to a standalone rider, you may attach an accelerated critical illness rider to a basic insurance policy. In like manner, this could be a term insurance policy, or a whole life insurance policy.

What happens after a Critical Illness claim a made (Single Claim benefit)?

In this situation, the critical illness rider will issue the payout. Thereafter, the insurer will terminate the rider. What’s more, the critical illness claim will reduce the sum insured under the basic insurance policy.

Based on the above example (in Part 4.2), we may claim $250k for critical illness. Thereupon, the death benefit will be reduced to $250k ($500k – $250k).

What happens when the critical illness coverage is equal to the basic death benefit?

In this case, the insurance policy will terminate after the claim.

Part 5: Critical Illness Insurance vs Healthcare Insurance

In essence, a healthcare insurance policy works on a reimbursement basis. To illustrate, you will need to present the medical bill to the insurer for assessment. Once the claim is approved, you will receive an amount that is equivalent to the cost incurred.

In other words, you will not receive any additional cash benefit. Even if you have ten healthcare insurance policies, the total payout from all the ten insurance policies will be exactly equal to the bill size.

Example: MediShield Life, Private Integrated Shield Plan

On the other hand, a critical illness insurance policy issues a payout regardless of the bill size. That is to say that even when you don’t seek medical treatment, you will still receive the critical illness insurance payout.

In detail, the size of this payout is determined at the point of application. Generally, the higher your insurance premium, the higher your insurance coverage (aka sum insured). Additionally, if you have ten critical illness insurance policies, then all the ten insurance policies will issue a payout (based on their respective sum insured).

Example: Term Insurance Policy, Participating Whole Life Insurance Policy

Part 6: Final Thoughts

All in all, a critical illness insurance policy provides an additional layer of financial protection for you. This is with the intention to ensure that you do not exhaust your hard-earned savings too rapidly.

We may use the payout to clear your outstanding liabilities to that end. This is for fear that we cannot resume work immediately. Moreover, this money can be used to take care of your living expenses as well as the ongoing medical cost. Hence, we do not have to worry about the continual cost of living. After all, nobody likes to be forced to go to work, especially when you are unwell.

Above all, we only live once, and health is wealth.

This post is part of Starter’s Guide! This means that I have taken extra time and effort to explain the basics of the presented topic in a simple manner. In effect, I hope this helps you to start responsible planning today. Subscribe to my newsletter if you like to see more of these content!

Leave a Reply