When you die without a valid Will in Singapore, the Intestate Succession Act will dictate your estate distribution. Under those circumstances, nobody has control over how the law distributes your estate. Given that the Intestate Succession Act is the law’s attempt to create a fair distribution, the legally entitled beneficiary may not be your intended beneficiary.

Author’s Note: The Intestate Succession Act does not apply to any Muslim. Consequently, it shall not affect any rules of the Muslim law in respect of the distribution of the estate of any such person.

Table of Contents:

- What is Your Domicile?

- Movable Property vs Immovable Property

- Nine Rules of Distribution

- Final Thoughts

One Minute Summary:

- In order to ascertain whether the Intestate Succession Act is enforceable, we need to determine your domicile and the type of property that you own.

- Altogether, there are nine rules of distribution under the Intestate Succession Act.

- To point out, there are multiple shortfalls under the default estate arrangement. Therefore, I will highly encourage you to draft a proper Will.

Part 1: What is Your Domicile?

To begin with, we need to determine your domicile in order to ascertain whether the Intestate Succession Act is enforceable. According to Oxford Dictionary, domicile refers to

The country that a person treats as their permanent home, or lives in and has a substantial connection with.

To put it another way, your domicile is the country where you intend to spend the rest of your life at. This is regardless of where you may be at this time. It is important to realise that we will apply the Intestate Succession Act if your domicile is in Singapore. To explain, this means that you own the rights to the use or benefit of the property situated in Singapore. For this purpose, the property may be movable or immovable, or both.

Part 2: Movable Property vs Immovable Property

Despite that (point in Part 1), we may still apply the Intestate Succession Act if your domicile is not in Singapore. However, you must possess the rights to the use or benefit of the immovable property that is situated in Singapore.

Example of Immovable Property: Land, benefits to arise out of land, and things attached to the earth or permanently fastened to anything attached to the earth.

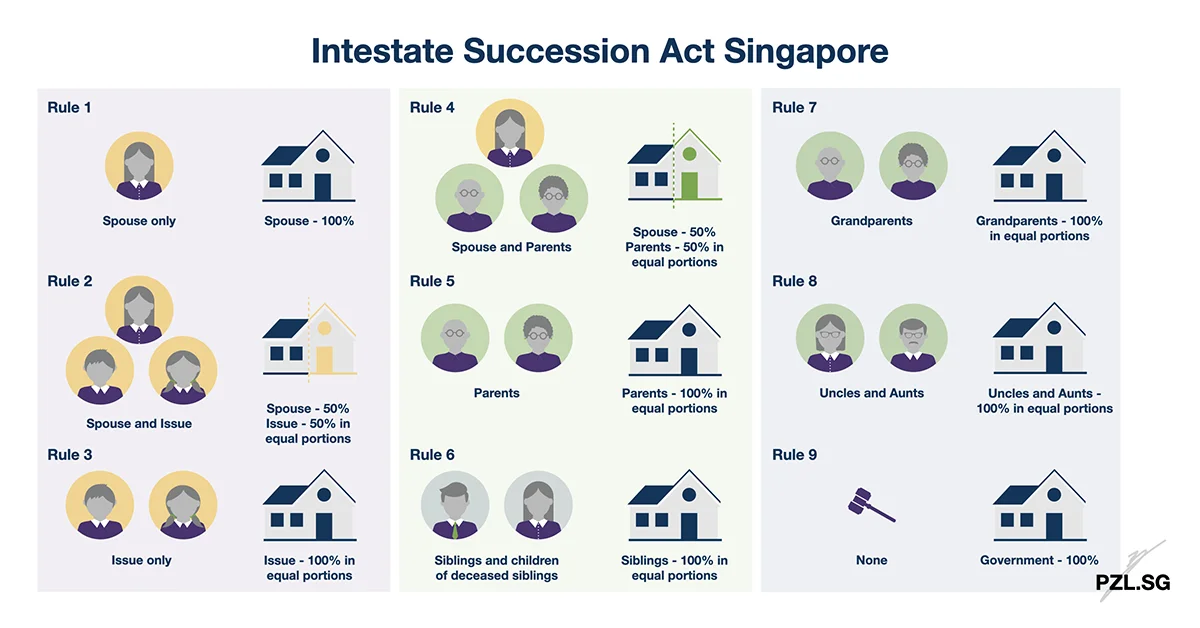

Part 3: Nine Rules of Distribution

Rule 1:

- Surviving: Spouse of the Intestate

- Absence: Issue (includes children and the descendants of the deceased children), Parent(s)

Given that your spouse is the only survivor, your spouse shall be entitled to the whole of the estate.

Rule 2:

- Surviving: Spouse, Issue, Parent(s)

On this occasion, your spouse shall be entitled to one-half of the estate. Next, your issue shall be entitled to the other half of the estate in equal portions. It is important to realise that your parent(s) are not entitled to the estate.

Rule 3:

- Surviving: Issue, Parent(s)

- Absence: Spouse

All in all, your issue shall be entitled to the whole of the estate in equal portions. Similar to Rule 2, your parent(s) are not entitled to the estate.

Rule 4:

- Surviving: Spouse, Parent(s)

- Absence: Issue

In this situation, your spouse shall be entitled to one-half of the estate. Meanwhile, your parent(s) shall be entitled to the other half of the estate in equal portions.

Rule 5:

- Surviving: Parent(s)

- Absence: Spouse, Descendants

By and large, your parent(s) shall be entitled to the whole of the estate in equal portions.

Rule 6:

- Surviving: Brothers and Sisters, and children of deceased brothers and sisters

- Absence: Spouse, Descendants, Parent

Be that as it may, your brothers and sisters shall be entitled to the whole of the estate in equal portions.

What if there is a deceased brother or sister?

In this case, the children of the deceased brother or sister shall take according to their stocks the share in which the deceased brother or sister would have taken.

Rule 7:

- Surviving: Grandparents of the Intestate

- Absence: Spouse, Descendants, Parents, Brothers and Sisters, children of such brothers and sisters

Summing up, your grandparents shall be entitled to the whole of the estate in equal portions.

Rule 8:

- Surviving: Uncles and Aunts of the Intestate

- Absence: Spouse, Descendants, Parents, Brothers and Sisters, children of such brothers and sisters, Grandparents

On this occasion, your uncles and aunts shall be entitled to the whole of the estate in equal portions.

Rule 9:

If the distribution under Rules 1 to 8 are defaulted, then the Government shall be entitled to the whole of the estate.

Part 4: Final Thoughts

Overall, the rules of distribution through the Intestate Succession Act may look fairly straightforward. However, I must highlight that this occurs only in the ending stages of wealth distribution.

Before your family is able to inherit your assets, they have to undergo the lengthy administrative process in order to obtain a Letter of Administration. Furthermore, a third party may contest the distribution. For one thing, this results in an unnecessary delay to the distribution process.

Nevertheless, the Intestate Succession Act is your final voice in the absence of the Will; I just hope that this voice speaks for the your intended wishes in due time.

First Published: 27 March 2019

Last Updated: 25 May 2021

Reference:

Intestate Succession Act (Cap. 146)

Leave a Reply