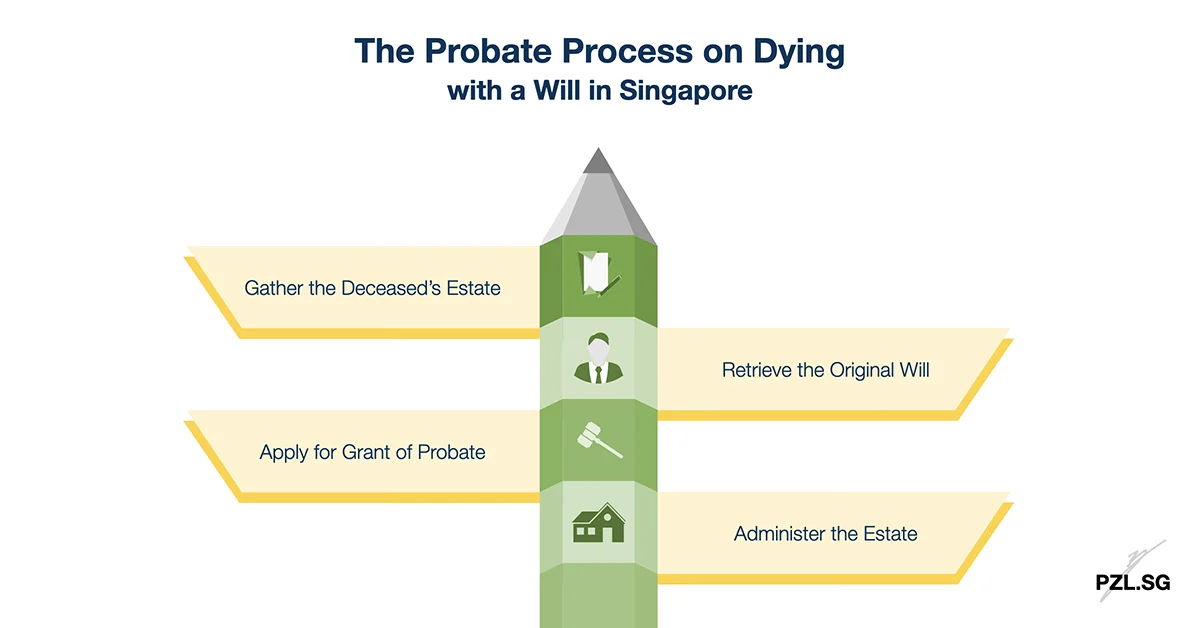

Overall, we will apply the probate process when you pass away with a valid Will in Singapore. For the most part, this process is more efficient than the administrative process (of dying without a Will).

Since the Will provides a clear direction on your estate distribution, we can complete the probate process earlier. There are four steps to complete to this end.

Table of Contents:

- Gather the Deceased’s Estate

- Retrieve the Original Will

- Apply for Grant of Probate

- Administer the Estate

- Is the Probate Process better?

One Minute Summary:

- The will is the anchor and provides the direction to complete the probate process.

- Given that clearer direction, we are able to speed up the probate process to realise your assets.

- It is most important to note that your executor needs to produce the original will. Therefore, you may wish to store it in an accessible location.

- After the probate process, your executor will distribute your estate according to what you write in the will.

- Since we need to rely on an executor for the probate process, be sure to choose someone trustworthy and responsible.

Part 1: Gather the Deceased’s Estate

Firstly, we will gather and find out the estate that you have left behind. In the same way, we will consolidate this information together with their respective value. In short, these information will form the “Schedule of Assets”.

Thereafter, we will check with the relevant institutions on whether a grant is required in order to realise the assets. This is because we may be able to transfer and distribute some assets without a grant.

Example: CPF monies, flats held under joint tenancies, certain insurance policies with nomination.

If a grant is not necessary, then we may proceed to distribute the assets directly. In other words, we do not need to wait for the probate process to be completed.

In the event that we cannot distribute the assets to your beneficiaries directly, there are two options:

Option 1.1: Value of Estate is less than S$50,000

In this situation, your next of kin may consider to apply to the Public Trustee to administer the estate. If the Public Trustee agrees to administer the estate, then a grant is not required.

Note: The Public Trustee charges a fee for the administration of estate.

Option 1.2: Value of Estate is more than S$50,000, or Public Trustee does not agree to administer the Estate

In this case, we may proceed to apply for a grant of probate. To be sure, we need to submit the application within six months from your death. Emphatically, we may submit an application in person, through a solicitor, or via legal aid.

Approximate cost: $1,000.00 (if you submit an application personally.)

Part 2: Retrieve the Original Will

In the latter case (Option 1.2), we need to retrieve the original will and apply for a grant of probate. This is owing to the fact that the Court requires us to present it together with your death certificate. This is so as to prevent foul play. To illustrate, you may have the intention to destroy the original will and not wanting it to govern the distribution. Hence, it is imperative is produce the original will for the probate process.

Part 2.1: Where to find the original will?

For this purpose, you may check with as many friends and relatives as you can. Additionally, you may use the Wills Registry to find out some basic information on the location of the will.

Part 2.2: What if your family cannot produce the original will?

In this situation, the Court may grant the probate to a copy or draft of the will. At length, this is limited until we admit the original will to probate. Furthermore, this copy must be identical in terms with the original will.

Part 2.3: Who is the Executor?

By and large, you would have appointed an executor in the will. Basically, his role is to

- Collect your assets;

- Clear your debts;

- Distribute the assets according to your will.

As you will agree, the executor’s role is vital in your estate distribution. Therefore, you should appoint someone who is trustworthy and responsible. In effect, this gives you a peace of mind that your estate will be handled in an appropriate manner.

What if the Executor is unwilling to act?

As a matter of fact, there will be situations when your executor is unwilling to handle your estate. For instance, he may be legally incapable, or has renounced the right to act as such.

Under those circumstances, an interested person may apply for a grant of letters of administration. Meanwhile, we will annex the will to that end.

Part 3: Apply for Grant of Probate

For Option 1.2, the executor will apply to the Court for a grant of probate. There are four stages to this end:

- File an Application for a Grant of Probate

- After You have submitted an Application

- The Supporting Affidavit

- Extract the Grant

Part 3.1: File an Application for a Grant of Probate

To begin with the application, we will prepare the Service Bureau Form for Application for Probate. Meanwhile, we also need to attend before a solicitor to certify as true copy for the supporting documents, e.g. Copy of Will.

Afterwards, we will conduct a check on the court’s record of probate cases and caveats filed in relation to the estate. For this purpose, it can be done at LawNet & CrimsonLogic Service Bureau.

It is important to realise that you need to make the search on the same day as the probate application, and for the present year. Correspondingly, you need to attach the summary report of the searches to the Originating Summons. This is together with the full report of any existing case or caveat.

Given that you have provided all the required documents, the Service Bureau will file the documents on your behalf.

Part 3.2: After You have submitted an application for Grant of Probate

On condition that the application is in order, the Court will

- accept the documents;

- assign a Family Court Probate (FC/P) number to the application; and

- fix a hearing date.

Thereupon, you may collect the accepted documents from the Service Bureau. Without delay, we need to prepare the Supporting Affidavit, and Administration Oath.

Part 3.3: The Supporting Affidavit

Above all, you need to prepare and file the Supporting Affidavit, and Administration Oath within 14 days of filing the application (Part 4.1).

To do this, we will prepare the Supporting Affidavit with a paragraph regarding the Schedule of Assets. Following that, we need to

- Affirm the Supporting Affidavit, and Administration Oath before a Commissioner for Oaths;

- File the Supporting Affidavit, and Administration Oath at the Service Bureau;

- Collect the accepted Supporting Affidavit, and Administration Oath from the Service Bureau.

The Court will grant the application in time to come. At this point, we will wait for the letter from the court regarding the Request to Extract the Grant.

Part 3.4: Extract the Grant

We need to prepare the Service Bureau form for the Request to Extract the Grant. In like fashion, we need to conduct a check on the court’s record of probate cases and caveats filed in relation to the estate. Likewise, we need to attach a summary report to the Request before submission. This process is similar to the one we did in Part 4.1.

In due time, the Court will process the Request and issue the Grant. Finally, you may collect the Grant from the Service Bureau.

All in all, this process takes approximately two to three months, depending on its complexity. Besides, this process could be extended if the documents are not in order. Thus, dying without a Will means that your beneficiaries will not inherit your estate promptly.

Part 4: Administer the Estate

Finally, the executor holds the responsibility to manage your estate within a reasonable period of time. Generally, this is the sequence:

- Manage your funeral, testamentary, and administration expenses;

- Clear outstanding liabilities, e.g. mortgage, credit card bills;

- Payment of the legacies and distribute the residue to the beneficiaries.

As you will agree, executorship is not easy as the executor needs to act in a diligent and responsible manner. At the same time, they are often volunteers and not paid for their job. On the contrary, they may need to fork out the legal fees from their own pocket to initiate the probate process!

Part 5: Is the Probate Process better?

On the whole, a will is the anchor and provides the direction to complete the probate process. Given that clearer direction, we are able to speed up the probate process and realise your assets. With this in mind, you ought to agree that we should draft a proper will.

By comparison, a simple will or a template may work if life is that simple. Since everyone’s needs are different,

should you rely on a one-size-fits-all template?

In any case, you should avoid copy-and-pasting potential loopholes into your final wishes.

Checklist:

- List down your assets and liabilities.

- Submit an insurance nomination for all your insurance policies.

- Draft a will today.

Reference:

Probate and Administration Act (Chapter 251)

First Published: 14 August 2019

Last Updated: 28 October 2020

Leave a Reply